The Role of Travel Insurance in International Travel

International travel allows us to experience new cultures and places by exploring ancient ruins, relaxing on a sandy beach, or trying exotic cuisine. But before you embark on an overseas adventure, it’s wise to consider safeguarding your trip with travel insurance.

While no one expects mishaps, travel insurance can provide vital support if the unexpected occurs far from home. Securing coverage ahead of overseas trips gives peace of mind to globe-trotting wanderers. In the section below, we’ll discuss the role of travel insurance for your international travel.

An Overview of Travel Insurance

The best digital nomad insurance is a type of insurance you can buy for trips you take. It helps protect you financially if something unexpected happens on your trip. For example, if you suddenly have to cancel your trip because you get sick or there’s a family emergency, travel insurance like my Safety Wing review, will refund you for what you already paid for flights, hotels, tours, etc.

Types of Travel Insurance Coverage

A. Medical and Health Emergencies

This covers you if you get sick or injured on your trip:

- Hospital expenses: Pays for hospital or doctor bills you must pay.

- Emergency medical evacuation: If local care isn’t good enough, it pays to transport you home or to a better hospital.

- Repatriation of remains: Pays to transport your remains home if you die abroad.

B. Trip Cancellation or Interruption

It covers you if you have to cancel or cut short your trip.

- Unforeseen circumstances: You must cancel because you or a relative gets sick, injured, or dies.

- Natural disasters: You must cancel or leave early because of a hurricane, flood, etc.

- Terrorism or civil unrest: Cancels or cuts short your trip due to events like terrorist attacks or violent protests.

C. Baggage and Personal Belongings

Pays for your lost, damaged or stolen luggage:

- Reimburses you for lost, damaged or stolen bags or items.

- It also covers costs if your bags are delayed.

Factors to Consider When Choosing Travel Insurance

A. Destination and duration of the trip

Where you are going and how long you will travel affects what kind of travel insurance you need. Going to a remote destination or travelling for a long time may mean you want more coverage if something happens.

B. Pre-existing medical conditions

A pre-existing condition is any health issue you already have when you buy travel insurance, like an illness you take medication for. Make sure to check if your policy covers pre-existing conditions.

C. Age and health of the traveller

Your age can impact how much your travel insurance costs. Some policies also have age limits on who can buy them. Health issues you have can also limit what policies you qualify for.

D. Coverage limits and deductibles

The limit is the maximum amount your policy would pay per event. If you’re willing to hand-pick the coverage options you want rather than pay for pre-packaged plans, choose Acko General Insurance. The flexibility to completely personalise protection is unique to ACKO. You get to build a tailored policy with exactly what you need – nothing more.

E. Type of activities planned during the trip

You may need special adventure sports coverage if you plan to do adventurous activities like mountain climbing (use Global Rescue for Everest insurance) or scuba diving. Check that your policy covers these activities.

F. Reputation and financial stability of the insurance provider

Make sure to check the ratings and reviews of the travel insurance company. You want to pick a trusted, stable provider who handles claims fairly for travellers. This ensures you can get policy payouts if needed.

Benefits of Buying Travel Insurance

Here are the benefits of buying travel insurance:

- Travel insurance gives you peace of mind knowing that you have financial backup if something unexpected happens on your trip, like needing medical treatment abroad or cancelling your trip at the last minute.

- Insurance protects you from significant costs connected to trip delays and interruptions, lost baggage, health emergencies away from home, and other costly inconveniences that can occur.

- Travel insurance lets you select coverage options for your specific trip and comfort level. You can get basic coverage or more extensive protection depending on your needs and budget.

- Suppose you book flights and hotels long in advance to get reasonable prices. In that case, travel insurance lets you make those non-refundable purchases confidently, knowing cancellation coverage will cover you if plans change unexpectedly.

The Bottom Line

Travel insurance plays a vital role in overseas trips by protecting wanderlust travellers financially. Though no one expects problems, having coverage means relaxing and enjoying your international adventure. Securing the right policy for your unique trip takes research but gives peace of mind. So consider travel insurance as your trusty companion for stress-free global journeys ahead. With coverage by your side, you’re ready to see the world and make magical memories.

Remember, never travel without travel insurance! And never overpay for travel insurance!

I use HeyMondo. You get INSTANT quotes. Super cheap, they actually pay out, AND they cover almost everywhere, where most insurance companies don't (even places like Central African Republic etc!). You can sign-up here. PS You even get 5% off if you use MY LINK! You can even sign up if you're already overseas and traveling, pretty cool.

Also, if you want to start a blog...I CAN HELP YOU!

Also, if you want to start a blog, and start to change your life, I'd love to help you! Email me on johnny@onestep4ward.com. In the meantime, check out my super easy blog post on how to start a travel blog in under 30 minutes, here! And if you just want to get cracking, use BlueHost at a discount, through me.

Also, (if you're like me, and awful with tech-stuff) email me and my team can get a blog up and running for you, designed and everything, for $699 - email johnny@onestep4ward.com to get started.

Do you work remotely? Are you a digital nomad/blogger etc? You need to be insured too.

I use SafetyWing for my digital nomad insurance. It covers me while I live overseas. It's just $10 a week, and it's amazing! No upfront fees, you just pay week by week, and you can sign up just for a week if you want, then switch it off and on whenever. You can read my review here, and you can sign-up here!

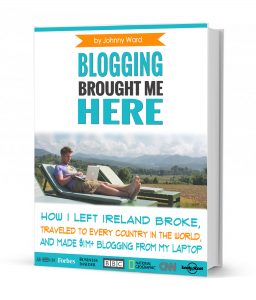

As you know, blogging changed my life. I left Ireland broke, with no plan, with just a one-way ticket to Thailand

and no money. Since then, I started a blog, then a digital media company, I've made

more than $1,500,000 USD, bought 4 properties and visited (almost) every country in the world. And I did it all from my laptop as I

travel the world and live my dream. I talk about how I did it, and how you can do it too, in my COMPLETELY FREE

Ebook, all 20,000

words or so. Just finish the process by putting in your email below and I'll mail it right out to you immediately. No spam ever too, I promise!

As you know, blogging changed my life. I left Ireland broke, with no plan, with just a one-way ticket to Thailand

and no money. Since then, I started a blog, then a digital media company, I've made

more than $1,500,000 USD, bought 4 properties and visited (almost) every country in the world. And I did it all from my laptop as I

travel the world and live my dream. I talk about how I did it, and how you can do it too, in my COMPLETELY FREE

Ebook, all 20,000

words or so. Just finish the process by putting in your email below and I'll mail it right out to you immediately. No spam ever too, I promise!