The Best Digital Nomad Insurance (FOR COVID TOO!); My Safetywing Insurance Review

UPDATE JUNE 2023: Safety Wing IS NOW COVERING COVID INSURANCE TOO! If you’re an ex-pat, a digital nomad or a long-term traveler, you need travel health insurance. Or even better, digital nomad insurance. Finally, for just $10 a week, you can have all the health insurance you need around the world for cheap. That, my friends, is a fact.

What’s also a fact is that I’ve never had it, for 10 years on the road. Stupid? Yup. Lucky? Hmmm, not really. I’ve broken my leg in Thailand, my foot in Korea, suspected Malaria in Burkina Faso, slipped 2 discs in my spine in Australia, broken hands, broken noses, broken shoulders, amongst various smaller injuries around the globe. To treat them, I either ignored them and hoped for the best (because I had no insurance and couldn’t afford to pay) or went to cheap local hospitals and got sub-par treatment.

Table of contents

- The Best Digital Nomad Insurance (FOR COVID TOO!); My Safetywing Insurance Review

- The Danger Of Traveling WITHOUT Safety Wing

- OVERVIEW; SafetyWing Review

- COMPARING WORLD NOMADS & SAFETYWING INSURANCE

- Quick check about what you’ll be covered for. Yaaay:

- SAFETYWING INSURANCE REVIEW HIGHLIGHTS:

- SAFETYWING REVIEW FAQ

- Alright, you got me, sounds pretty epic. But what’s the catch? Why is Safety Wing insurance So Cheap?

- How do I sign up?

- How Do I Know Where I can Get Treated?

- What Do They Cover Exactly?

- What do the terms health insurance, travel insurance and deductible mean with insurance?

- How To Cancel SafetyWing Insurance

- How Do You File An Emergency Claim With SafetyWing?

- Where Can You Travel With SafetyWing Insurance?

- Who Can Sign Up SafetyWing?

The Danger Of Traveling WITHOUT Safety Wing

Don’t travel without insurance. It’s simple, perfect advice.

Previously I was winging it, and it has been starting to stress me out. Now I realise I NEED health care. What if something goes wrong? Motorbike crash? Mugging? I spend a lot of my time in Thailand, and various other countries throughout the year, and the reality that I had NO health cover anywhere other than back in Ireland & the UK, has been playing on my mind. Not any longer. I’ve finally sorted it, and I’m going to show you guys how to do it too. And for cheap!

*Don’t be like me, having to use cheap Government Hospitals around the world (see below) when you can go to the best private hospitals in the country for $10 a week!

OVERVIEW; SafetyWing Review

SEPTEMBER 2021 EDIT: FIRSTLY, DOES SAFETYWING INSURANCE COVER YOU FOR COVID-19? YES, IT DOES!

SafetyWing is the best digital nomad insurance, or long-term traveler insurance available. If you don’t have travel medical insurance, then get it. You’ll have PRIVATE HEALTH CARE IN ALMOST EVERY COUNTRY IN THE WORLD FOR $10 PER WEEK (CLICK HERE TO GET INSURED)!

SafetyWing’s travel & medical insurance plan costs just $37 for every 4 weeks & with awesome emergency medical and dental coverage, $3,000 of lost luggage coverage and a $250,000 maximum limit. In other words, it offers the best value of any travel and medical insurance plan on the planet.

| Your Age | Monthly Price | Monthly Price (including USA) |

| 18-39 | $37 | $68 |

| 40-49 | $60 | $111 |

| 50-59 | $94 | $184 |

| 60-69 | $128 | $251 |

Why Did I Choose Safety Wing Insurance?

For most digital nomads or long-term travellers, digital nomad health insurance is just something that you’ll get around to. But never do. Then disaster strikes and you wish you did. I know the feeling. And it’s such a complicated world. Deductibles, excess, liability. I was so confused and because of that, I stuck my head in the sand. Finally, this month I decided to get it fixed once and for all.

After researching the most famous travel insurance in World Nomads, and then researching the new kids on the block, SafetyWing, I decided to go with the latter. Why? For a start, SafetyWing works as COVID insurance for Thailand now too, brilliant!

COMPARING WORLD NOMADS & SAFETYWING INSURANCE

I know, I know. EVERYONE seems to recommend World Nomads. I also used to. It’s user-friendly and super easy to sign up. But wanna know why most bloggers recommend it? Because they pay huge commission compared to any other insurance provider (sssssh industry secret, don’t tell anyone!). So when I finally got my act together to get medical insurance for my travels, I assumed I too would get World Nomads. I always thought it was cheap, I was a little shocked to see it cost about $1300 a year (it’s no wonder I never had it!).

So let’s compare SafetyWing and World Nomads and see why I choose Safety Wing.

PRICING:

SafetyWing: $37 for 4 weeks. Bargain!

World Nomads: Starting* at approximately $120+/month

FLEXIBILITY:

SafetyWing: You can sign up at home OR when you’re already traveling. The monthly fee is rolling (like Netflix), so you don’t have to sign up for X amount of months, you just keep it running while you travel or live overseas. Every travel insurance should do this, but alas they don’t.

World Nomads: You can sign up at home OR when you’re already traveling. You have to buy a pre-determined amount of time (3 months in South East Asia for example).

TRAVEL MEDICAL INSURANCE:

Safety Wing: First and foremost, SafetyWing is ridiculously cheap medical insurance as you travel. Safetywing insurance covers unexpected illnesses and injuries sustained abroad, including expenses for hospitals, doctors and prescription drugs. It also covers emergency travel-related benefits such as emergency medical evacuation, emergency dental treatment, travel delay/interruption and lost luggage.

It even offers coverage in your home country, perfect for the frequent traveler who still likes to visit home once in a while. Americans have 15 days of home country coverage for every 90 days of their policy, while everyone else gets 30 days of home country coverage for every 90 days of their policy.

World Nomads: Triple the price of SafetyWing, similar medical insurance.

TRAVEL INSURANCE:

SafetyWing: Travel delays out of your control, does not include missed flights Lost checked luggage is covered up to $3k with $500 per item. Stolen and broken electronics are not covered, they’re updated plan later in the year will cover this though. Also, they even cover kidnap/ransom kinda stuff! Quality peace-of-mind when you go join me on my tours to countries like Yemen, Syria, etc (just kidding, we’ll be fine!)

World Nomads: The same as above but also includes stolen goods up to $500 per item. For triple the price, and the slim chance of having stuff stolen, not worth it in my eyes.

COVERAGE

SafetyWing: THE WHOLE WORLD (apart from North Korea, Cuba and Iran)

World Nomads: The whole world.

CONCLUSION?

Pretty simple really. SafetyWing is the clear winner. It’s a 1/3 of the price of it’s biggest competitor, World Nomads, AND you pay monthly rather than a one-off fee! It’s an unbelievable product that gives me (or you) private health insurance all around the world, in almost every single country, all year round for $10 a week. That’s honestly crazy. It makes me feel pretty stupid that I’ve never had it before, to be honest. Better late than never though. Click here to finally make sure you’re covered for health insurance while you’re not in your home country.

Quick check about what you’ll be covered for. Yaaay:

SAFETYWING INSURANCE REVIEW HIGHLIGHTS:

I wanted to feel confident in finally endorsing one travel medical insurance above another, so after more and more research, I looked deeper still into SafetyWing so I could outline all their highlights. Here’s why I finally, FINALLY took out insurance with these guys:

- MONTHLY BILLING: NO ONE-OFF PAYMENT! You pay each month, direct from your debit card or credit card, just like Netflix. You don’t need to sign up for any length of time. Month by month. Amazing.

- PRICE: It’s the cheapest, by a mile. Most company’s charge $100+ minimum for private health care insurance. To pay $37 is amazing. Travel insurance finally reached where it’s stupid NOT to have it. At last.

- PRIVATE HEALTH CARE: I never understood how travel insurance worked. But with these guys, you hop into their website, log in to your profile and check which private hospitals you can visit whether you’re in Bangkok, Bali or Beirut (and it’s almost all of them!).

Home country cover?!

- Private Health Care in YOUR HOME COUNTRY: Yup, even when you’re at home you can visit private hospitals for up to 30 days for every 90 days you have coverage. Crazy.

- DIRECT BILLING: Unlike most insurance companies, most of the time you visit a hospital you don’t have to pay and then claim it back. The bill goes straight to these guys.

- SIMPLICITY: No bronze/silver/gold stuff. Pay your $10 a week and you’re covered. And sign up, or cancel, at any time. It takes 5 minutes. How it should be.

- YEARLY DEDUCTIBLES. That means ‘excess’ in the UK. So it’s the amount you have to pay when you first claim (like if you’re TV is broken or stolen at home you have to pay like $250 then, the insurance company covers the rest). These guys do a yearly version, so you don’t have to keep paying the first portion of every claim. $250 a year is the max you can pay as an excess/deductible PER YEAR. Unreal.

- OFTEN NO DEDUCTIBLES: For stuff like lost checked luggage, travel delays, crisis response, emergency dental, medical evacuation, trip interruption, personal liability you don’t have to pay any deductible. Pretty cool.

SAFETYWING REVIEW FAQ

Alright, you got me, sounds pretty epic. But what’s the catch? Why is Safety Wing insurance So Cheap?

They’re smart! They have no middlemen, they don’t treat existing conditions so no big cancer bills, or chronic illness bills, and they only have 1 simple policy.

How do I sign up?

Now we’re talking! Go to the SafetyWing.com, in the top right-hand corner you’ll see ‘Sign me up’. Click Register, and then register with either your email or your Facebook account, throw in the information (name, country of residence) you’re done and dusted! You’re now officially insured!

How Do I Know Where I can Get Treated?

Simple. Once you’ve signed up, you hop on SafetyWing.com and at the top you’ll see “Find Hospital or Doctor” right there on the main menu. Search your location, and you’ll see endless private hospitals, clinics and specialists. When you then go to the hospital, show your SafetyWing profile (it’s an online card, but you can print it off if you want). From there, normally the hospital will just send your bill to SafetyWing (occasionally you may have to pay first and then get re-paid, but rarely)

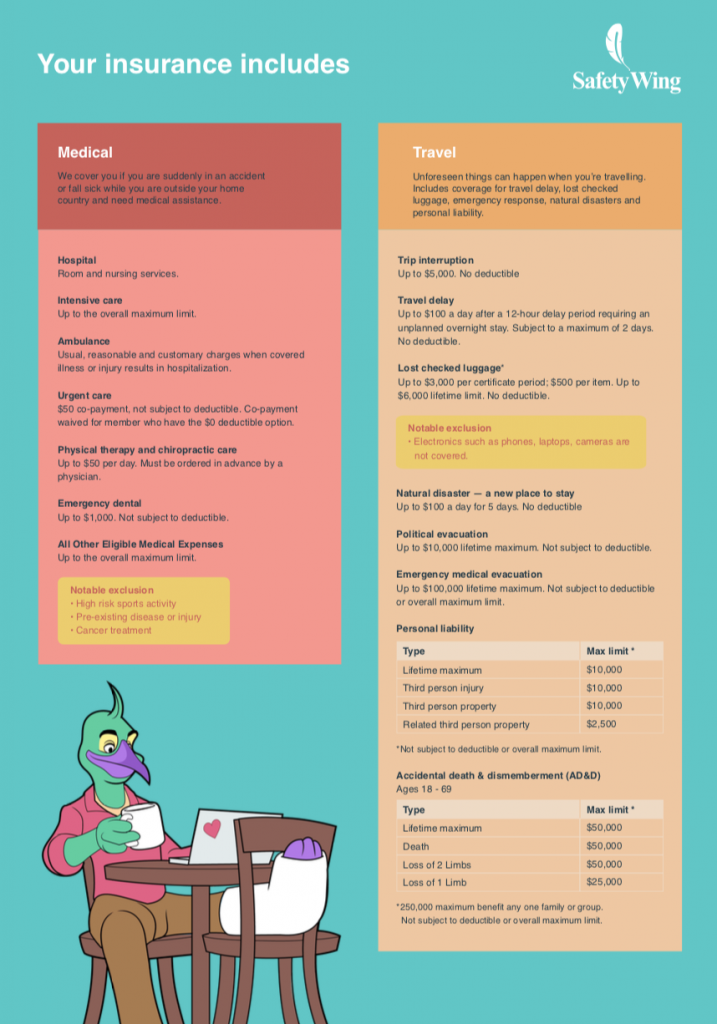

What Do They Cover Exactly?

Pretty much every health concern you’re ever going to likely need when you travel or live overseas. Check it out here:

| Benefit | Limit |

| Benefit Emergency Room Visit | None |

| Urgent Care Center | None |

| Emergency Dental | $1,000 |

| Acute Onset of Pre-Existing Condition | None |

| Terrorism | $50,000 |

| Emergency Medical Expenses | None |

| Emergency Medical Evacuation | $100,000 |

| Trip Interruption | $5,000 |

| Lost Checked Luggage | $3,000 ($500 per item) |

| Personal Liability | $10,000 |

*SafetyWing’s policy has a maximum limit of $250,000, which means they won’t pay out more than $250,000 in any single coverage period. The items with no limit listed above are also subject to this $250,000 maximum limit.

What do the terms health insurance, travel insurance and deductible mean with insurance?

Those were my questions! Health/medical insurance is when you’re sick or ill and need treatment. SafetyWing is amazing for this. Travel insurance is when your flight is canceled, or delay, or you lost your bag, or you’ve been mugged etc. SafetyWing covers you for most of this stuff too apart from your electronics. The Deductible (or ‘excess’ in Europe) is the amount you have to pay first before your insurance kicks in. Say you break your lef in Thailand in a motorbike crash (errm, guilty. Twice), and the bill is $15,000USD for an amazing first-class hospital, private bed, etc, you have to pay the first $250, SafetyWing picks up the rest. The $250 is known as the Deductible. Insurance companies used it to make sure people are constantly scamming them basically.

How To Cancel SafetyWing Insurance

Finally, a company who knows we don’t want, or need, to jump through 5000 hoops to cancel something! You just login to their website and click Cancel. You’ll be covered up until the end of your $37 4-week plan. No letters, no phone calls. Done.

How Do You File An Emergency Claim With SafetyWing?

Dial the phone number for your local representative as shown on their website. Or you can call their global office at +1-317-262-2132. If you’re filing a medical claim, you can either do it online by emailing the form to service@hccmis.com. (All claims must be filed within 60 days of when the insurance period ends.)

Where Can You Travel With SafetyWing Insurance?

EVERY COUNTRY IN THE WORLD* (almost). North Korea and Iran are excluded, other than that, you’re good to go.

Who Can Sign Up SafetyWing?

Anyone. Any nationality. You can use it for your travel medical insurance for a short trip, or if you lived overseas, are a digital nomad/expat, or a long-term traveler, you can use it indefinitely as your health insurance (that’s what I now do). Just click here, and within 5 minutes, you’ll be covered too. The value of the peace of mind it brings is crazy. Don’t be like me in my wild youth, get yourself covered HERE.

If I recommend SafetyWing to others, can I get paid?

Yes you can! I love SafetyWing, and I used to recommend it to others all the time using the normal link to their website. But I signed up to SafetyWing affiliate and now I make a little commission off each person, I made $3k last year from it! I blogged about my SafetyWing Affiliate review here, so check it out, sign up HERE to be a SafetyWing Ambassador (it’s free) and you too can make money when you recommend it too. Why wouldn’t you do that?!

Remember, never travel without travel insurance! And never overpay for travel insurance!

I use HeyMondo. You get INSTANT quotes. Super cheap, they actually pay out, AND they cover almost everywhere, where most insurance companies don't (even places like Central African Republic etc!). You can sign-up here. PS You even get 5% off if you use MY LINK! You can even sign up if you're already overseas and traveling, pretty cool.

Also, if you want to start a blog...I CAN HELP YOU!

Also, if you want to start a blog, and start to change your life, I'd love to help you! Email me on johnny@onestep4ward.com. In the meantime, check out my super easy blog post on how to start a travel blog in under 30 minutes, here! And if you just want to get cracking, use BlueHost at a discount, through me.

Also, (if you're like me, and awful with tech-stuff) email me and my team can get a blog up and running for you, designed and everything, for $699 - email johnny@onestep4ward.com to get started.

Do you work remotely? Are you a digital nomad/blogger etc? You need to be insured too.

I use SafetyWing for my digital nomad insurance. It covers me while I live overseas. It's just $10 a week, and it's amazing! No upfront fees, you just pay week by week, and you can sign up just for a week if you want, then switch it off and on whenever. You can read my review here, and you can sign-up here!

As you know, blogging changed my life. I left Ireland broke, with no plan, with just a one-way ticket to Thailand

and no money. Since then, I started a blog, then a digital media company, I've made

more than $1,500,000 USD, bought 4 properties and visited (almost) every country in the world. And I did it all from my laptop as I

travel the world and live my dream. I talk about how I did it, and how you can do it too, in my COMPLETELY FREE

Ebook, all 20,000

words or so. Just finish the process by putting in your email below and I'll mail it right out to you immediately. No spam ever too, I promise!

As you know, blogging changed my life. I left Ireland broke, with no plan, with just a one-way ticket to Thailand

and no money. Since then, I started a blog, then a digital media company, I've made

more than $1,500,000 USD, bought 4 properties and visited (almost) every country in the world. And I did it all from my laptop as I

travel the world and live my dream. I talk about how I did it, and how you can do it too, in my COMPLETELY FREE

Ebook, all 20,000

words or so. Just finish the process by putting in your email below and I'll mail it right out to you immediately. No spam ever too, I promise!