CURVE Card Travel Benefits; How My Curve Card Saved me!

Managing my money while I travel the world, and live in Thailand, used to be tough. But recent fintech companies have been making it much easier. Both as setting up as a digital nomad with things like digital nomad insurance, invoicing as a freelancer, and also on how to make sure you can access your money without fees when you’re in different countries.

I’ve been using my Curve Card (CHECK THEM OUT HERE, use my link and get £5 for signing up and using it!) for almost a year now. I decided to experiment with getting a Curve Card when I heard about the Curve Card Travel benefits that came with membership (more on that below). But in the end, those travel benefits were just one of the reasons why I fell in love with Curve. In fact, my Curve Card saved me more than once.

TLDR? If you guys don’t know what the Curve Card is, you can check out my Curve Card Review here (and read why 3 million people use it!).

Table of contents

Remind me what the Curve Card is again?

Basically, the Curve Card stores all your other card details on ONE CARD. So you don’t need to carry a wallet or purse, full of cards. You input the data of your other cards into the Curve App, then you only need to carry one physical card, the Curve Card.

On top of consolidating your cards, there are loads of other benefits – I discuss them at length in my Curve Card Review, but here are a few of the best travel benefit ones!

- Free withdrawals at the REAL exchange rate when you take money out overseas

- Travel insurance

- Phone insurance when you’re traveling (FINALLY!)

- Super cheap airport business class lounge access, even when you fly economy.

- Paid with the wrong card in a shop? No worries, go back in time and change the card you used!

- There are loads more, but just know, it’s an epic card.

Curve Memberships?

I explain all about the 3 different memberships Curve offers in my Curve Review, but basically, there are 3 tiers. Blue (100% free), Black (9 quid a month), Metal (14.99 a month). Curve sorted me out with a Metal membership back in August and, as a traveler, it’s been the best. It’s the Metal membership that gave me cheap airport lounge access AND the phone insurance overseas while I travel.

Also, there are limits on the free ATM withdrawals and expenditures overseas on the free Blue membership (500€/month spend, and 200€/month ATM). But with Metal membership, you’re good to go with up to triple that on ATM withdrawals, and unlimited spend. So that’s me covered.

How Using My Curve Card Saved Me Overseas

Even during the Pandemic, I’ve tried to do some cool stuff (and I don’t mean the harrowing experience of rowing the Atlantic at the start of the year, yikes). Towards the end of the year, I organised a Mauritania Tour, to hitch a ride and ride the Iron Ore train through the depths of the Sahara. And then directly after that, I organised a group to do the Serengeti Marathon. With my 72-year-old mum! We raised $15k towards a cure for Parkinson’s. Anyway, that’s a whole other blog post.

The point is, I was in both West Africa, and then East Africa last year. And both times the Curve Card travel functions saved me.

Withdrawing money overseas with my Curve Card

Previously, I had always used a Wise (formerly Transferwise). And they had been great. But in Tanzania, my Wise visa debit card wasn’t being accepted by any ATMs in Arusha or Dar Es Salaam. Sh*t!

What now? I thought I’d have to use my UK or Thai cards. And we all know if you use your home cards in foreign countries, you get KILLED on fees and exchange rates. And I was running group trips here. I needed thousands and thousand of dollars. I would be charged hundreds. Eurrrgh.

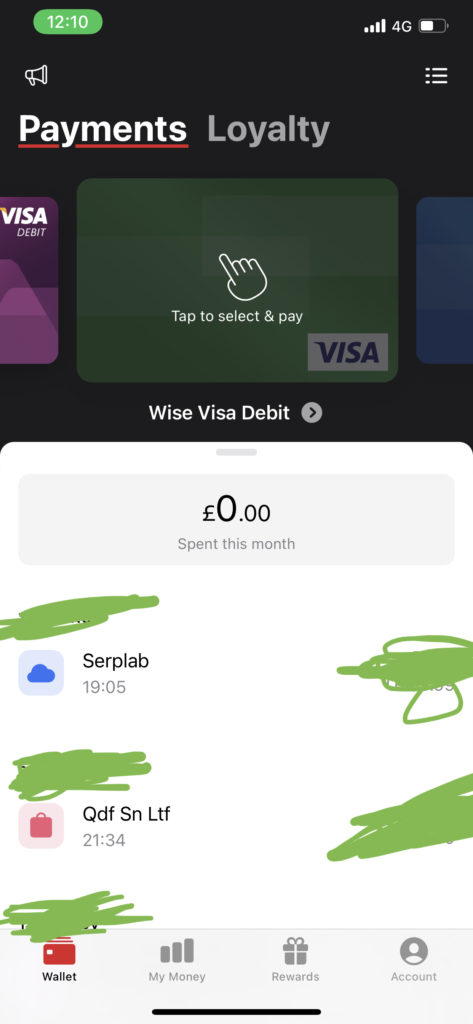

But, nope, my Curve Card saved me! I hopped onto my Curve App. Selected my Wise Visa Debit Card as the card to withdraw money from. Put the CURVE metal card into the ATM. And voila. I had a pocket full of cash. I access a different (visa!!) account using my Curve Mastercard. Genius.

Top-Top for managing money when traveling

You never know which card will work, both for ATM withdrawals and for paying with card. Visa/Mastercard/Amex, whatever. But often one will fail. Curve fixed that problem for me. I could access any of my visa cards WITH my Curve Mastercard, even if the ATMs in Tanzania didn’t want to allow my Visa card. Brilliant.

How Curve Saved Me A Second Time

I was relieved that I could access my money again. But my Curve travel benefits didn’t end there. Suddenly, out of the blue, Wise cancelled and deleted my account (a common theme with Wise, be warned). That meant that I could only use my foreign cards overseas, or my trusty Curve Card. So for the rest of my trips in Mauritania and Tanzania (and Thailand when I returned ‘home’ here), I could withdraw money from the ATM with no fees, and the real exchange rate. Glorious. Thank you Curve.

And an Airport Lounge Visit for $20

And the final additional benefit of my Curve Metal was of course the cheap lounge access. Some of you guys know that you can access airport lounges (you know, free flow champagne and snacks) even when you fly economy IF you have access. You get access to these with either something called Priority Pass (I wrote a detailed Priority Pass review here so you can understand) or by buying entrance to each lounge.

Each lounge can be priced anywhere from $40 all the way up to $300+! Really. But with my Curve Metal, you get enrolled into ‘Lounge Key’, which gives you access to airport lounges for 20GBP pretty much everywhere.

So after all the stress of my trips in Africa, a 7 hour layover in Qatar/Dubai/Nairobi suddenly becomes a lovely experience with wine, work and comfort. All for 20 quid!

Final Thoughts on Curve Card Travel Benefits

The Curve Card has over 2 million users. So I’m not the first person to discuss how brilliant it is. Most people love it because it means they now only have to carry one physical card, and that’s great. But for me, its’ the Curve Card travel benefits that helped me. It saved me with ATM withdrawals, it saved me when other companies cancelled accounts, it saved me in airports. And if I broke my phone (common with me!), it is ready to save me with my phone insurance while I travel.

That’s an absolute win in my book. So thanks Curve. You had my back, so now I’ve got yours. You can also check out all the Curve stuff with THIS LINK HERE, so you can see why I’m raving about it.

Remember, never travel without travel insurance! And never overpay for travel insurance!

I use HeyMondo. You get INSTANT quotes. Super cheap, they actually pay out, AND they cover almost everywhere, where most insurance companies don't (even places like Central African Republic etc!). You can sign-up here. PS You even get 5% off if you use MY LINK! You can even sign up if you're already overseas and traveling, pretty cool.

Also, if you want to start a blog...I CAN HELP YOU!

Also, if you want to start a blog, and start to change your life, I'd love to help you! Email me on johnny@onestep4ward.com. In the meantime, check out my super easy blog post on how to start a travel blog in under 30 minutes, here! And if you just want to get cracking, use BlueHost at a discount, through me.

Also, (if you're like me, and awful with tech-stuff) email me and my team can get a blog up and running for you, designed and everything, for $699 - email johnny@onestep4ward.com to get started.

Do you work remotely? Are you a digital nomad/blogger etc? You need to be insured too.

I use SafetyWing for my digital nomad insurance. It covers me while I live overseas. It's just $10 a week, and it's amazing! No upfront fees, you just pay week by week, and you can sign up just for a week if you want, then switch it off and on whenever. You can read my review here, and you can sign-up here!

As you know, blogging changed my life. I left Ireland broke, with no plan, with just a one-way ticket to Thailand

and no money. Since then, I started a blog, then a digital media company, I've made

more than $1,500,000 USD, bought 4 properties and visited (almost) every country in the world. And I did it all from my laptop as I

travel the world and live my dream. I talk about how I did it, and how you can do it too, in my COMPLETELY FREE

Ebook, all 20,000

words or so. Just finish the process by putting in your email below and I'll mail it right out to you immediately. No spam ever too, I promise!

As you know, blogging changed my life. I left Ireland broke, with no plan, with just a one-way ticket to Thailand

and no money. Since then, I started a blog, then a digital media company, I've made

more than $1,500,000 USD, bought 4 properties and visited (almost) every country in the world. And I did it all from my laptop as I

travel the world and live my dream. I talk about how I did it, and how you can do it too, in my COMPLETELY FREE

Ebook, all 20,000

words or so. Just finish the process by putting in your email below and I'll mail it right out to you immediately. No spam ever too, I promise!