Curve Card Review; Managing my Money with the Curve Card in 2023

Times are changing. And my oversized wallet is finally catching up. So here’s my beautiful Curve Card review, and with it, you’ll be dispensing with your million and 1 cards currently wedged in your wallet or purse, for just one or two. Ever. There’s a reason over 2 million people are using Curve (and it’s not just the free 5 quid you get from signing up with my link, although that’s nice too).

So what am I talking about? Well, you know how most people have 2 or 3 Visa cards, a debit card, a MasterCard, or two? And you spend as much time flicking through cards in your wallet as you do with actually choosing the product or paying for the product?!

Yet your iPhone has countless apps, but it doesn’t quite match up with your wallet. Finally, they’re in sync, thanks to the Curve Card. With a valuation of over half a billion dollars, and another recent round of 72m GBP, these guys are here to stay.

On top of all that, if you’re from the UK (or EU, and very soon the US too) not only does the Curve card mean you can throw away almost all your other cards, it also means you get a load of other bonuses thrown in too . Like what for example? Like iPhone insurance, even when you’re overseas (soooo good for people like for me. Or like 1% cashback on all your purchases! Yup, got your attention now, right?

Still don’t quite get it? Don’t worry, read on. Or if you’re fed up with 5 different bank cards in your wallet, and you want to carry just one, join the other 2,000,000+ users and sign up for free here.

Table of contents

- Curve Card Review; Managing my Money with the Curve Card in 2023

- What is the Curve Card?

- What are the benefits of the Curve Card?

- What? So Different banks, but one card?!

- Different Curve Membership Options & Prices

- Which Curve Membership is best?

- What are the travel benefits of the Curve Card?

- Do I Have to be from the UK or EU to get the Curve?

- Talk to me about Amex and the Curve?

- How much is Curve Metal?

- Final thoughts on my Curve Card Review

What is the Curve Card?

ALL YOUR WALLET, IN ONE CARD!

Ok, so the Curve card and the Curve app go hand in hand. To break it all down, you get a card from Curve, and that one card organizes all your other kazillion cards in your wallet and consolidates them, even from different banks, into one physical card.

With Curve, there is no longer any need to carry all the other bank cards that you own at all. You can use all those cards via your own Curve card. You simply use the app to manage which of your various cards you want to spend on. But then you use the one same, sleek card to actually physically pay for anything or everything. And if you made a mistake and clicked the wrong card in the app? You can reverse the payment and switch it over to another card. Amazing.

What are the benefits of the Curve Card?

First off, if you have a Newest account, a Lloyds account, and a Barclays account. You no longer need to carry 3/4/5 cards. The Curve Card syncs them all into just one physical card, and the app lets you swipe through and choose which to pay with. But that’s just the start. Here are the other benefits in my Curve card review:

- £5 BONUS JUST FOR SIGN UP (FOR FREE) AND USING YOUR CARD ONCE!

- Only need to carry one card from now on. FINALLY!

- Curve Balance. Rather than having to log-in to each banking app to see where your finances stand before you buy something. Hop on the Curve app and swipe beween your cards/accounts, which displays your account balance right there.

- 1% CASHBACK on everything in your first month (anywhere in the world, even for me here in Thailand)! And then 1% cash back for another month for every person you refer. Kaching.

- PROPER EXCHANGE RATES & free withdrawals when you travel. Stop letting the banks steal our money by charging crazy exchange rates when you take money out when you travel. Any card you attach to Curve uses Curve rates, not their own.

- ANTI-EMBARRASMENT MODE. God do I ever remember this. With the Curve card, if one of your cards bounces, it auto-uses a pre-selected back-up card. No more “the rounds are on me boys… errr.. maybe not!“

- GO BACK IN TIME. Used the wrong card? You can go back and switch which card you used up to 90 days back. You can even go back and switch from a debit card, to a credit card to free up money. Amazing.

- ZERO CARDS? Curve can connect to Apply pay, Google Pay and Samsung pay, so if you’d prefer to go entirely card-free you can!

- CURVE METAL. Their premium (and best) product. This is the one with the phone insurance, EVEN OVERSEAS!

- CHEAP LOUNGE ACCESS. If you use Curve Metal, you’re enrolled with LoungeKey. So you can present your card at the airport lounge and you’ll only pay 20GBP per lounge access. Sometimes lounges exceed 100quid, this is a winner.

£5 BONUS FOR SIGNING UP WITH ME!

Does ANYONE in the UK want a free FIVER? If you use MY LINK HERE, and sign up, the first time you use your card, you’ll get £5 FOR FREE.

Also, you’ll get 1% cashback on ALL PURCHASES for 30 days too. Free money. Can’t ask more than that eh?

Remember, you only get it if you use my link: https://curvecard.sjv.io/c/1960591/1144194/12851

What? So Different banks, but one card?!

Yes, that’s the whole thing! You have all your debit cards, credit cards and loyalty cards consolidated on one physical card. Then you use the app to select which card you want to pay with, then when you tap your Curve card, it uses the card you chose. Winner.

Different Curve Membership Options & Prices

There are 3 different Curve memberships. One of which is free! They are as follows, with the following differences:

Curve Blue Review:

- FREE. No monthly fee.

- Access to fair FX rates (500€ per month limit).

- Go Back in Time: Move 90-day old payments, up to 5,000€, and switch which card you paid them on.

- Curve Customer Protection up to 100,000€.

- 1% cashback for the first 30 days.

Curve Black Review:

- 9.99€ or GBP/month.

- Access to fair FX rates. Unlimited.

- Go Back in Time: Move 90-day old payments, up to 5,000€.

- Curve Customer Protection up to 100,000€.

- Worldwide Travel Insurance.

- 1% cashback for the first 30 days PLUS 1% cashback forever with 3 retailers you select.

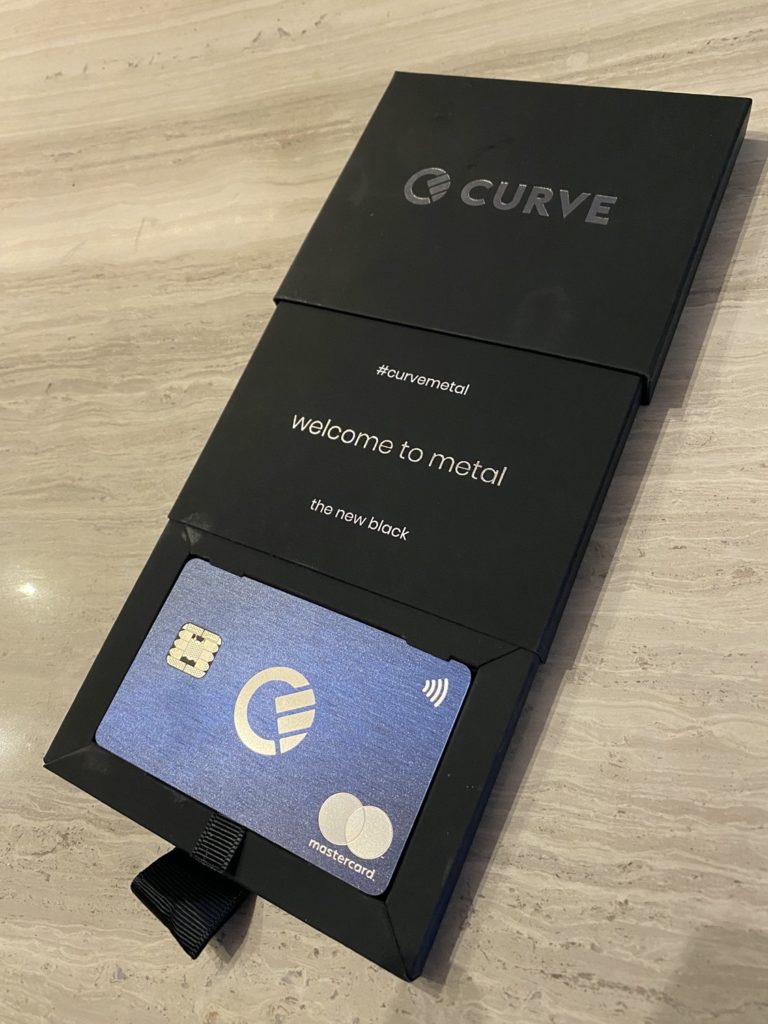

Curve Metal Review (this is the card I use):

- 14.99€ or GBP/month

- Access to fair FX rates. Unlimited.

- Go Back in Time: Move 90-day old payments, up to 5,000€

- Curve Customer Protection up to 100,000€

- 1% cashback for the first 30 days PLUS 1% cashback forever with 6 retailers you select.

- Worldwide Travel Insurance.

- MOBILE PHONE INSURANCE.

- Worldwide Airport LoungeKey Access.

- A sexy metal card. Sounds ridiculous, but having had the Amex Platinum, it’s a lovely extra. I miss mine every day!

Which Curve Membership is best?

For me, as a traveler, Curve Metal.

Why? The unlimited spending overseas at fair exchange rates is a gem. And my (awesome) Safetywing digital nomad insurance doesn’t cover my phone, so having mobile phone insurance with Curve Metal is a gem. And, none of my current credit cards give me a priority pass membership, so right now I have NO LOUNGE ACCESS in airports. So the Loungekey membership giving me access to business class lounges at pretty much every airport in the world for just 20 quid is a winner.

If you’re on the fence though, go Curve Blue. It’s FREE! And you still get cashback, you get fair exchange rates when you travel, and you can still switch payments etc, and only need to ever carry one card (and maybe an Amex too). It’s a no-brainer.

TLDR? If you travel a chunk, Curve Metal is worth it. If not, stick with Blue (for free!).

What are the travel benefits of the Curve Card?

I covered them above, but considering I’m always on the move I want to consolidate the travel benefits from having my Curve Card. So here we go.

The Curve Card Travel Benefits in short:

Cheap lounge access by giving LoungKey membership (20 quid lounge access pretty much anywhere!). T

ravel and phone insurance overseas.

REAL exchange rates when you take money out on any of your cards that are linked to your Curve account.

And you only need to bring your curve key out and about with you, leave the ‘real’ cards stashed away secretly in your hotel safe. Winner.

Do I Have to be from the UK or EU to get the Curve?

Not just the UK. Pretty much anywhere in the EU (including my home country, Ireland) and the US is just about to be added. Curve is here to say.

Talk to me about Amex and the Curve?

Curve used to accept American Express too, but Amex stopped their partnership (scared of a little competition, huh Amex?). So that’s the one downside, as you guys know, collecting Airmiles in the UK is tough. and you NEED an Amex if you want free upgrades using airmiles.

So, because Amex doesn’t let you plug in their details to Curve, it means you need your Curve AND your Amex. One thing I would say though is, anywhere accepting Amex, also accepts Apple/Samsung/Google pay, so you don’t generally need to carry your physical Amex actually.

How much is Curve Metal?

My Curve card review showcases all the benefits of the card. But Curve metal is the premium Curve card. And it’s the one I would personally recommend, especially if you travel a lot, or want to live the digital nomad dream. It’s 14.99GBP per month, but as I mentioned above, this covers your mobile phone overseas, covers travel insurance AND you get LoungeKey membership. That means you can pay for cheap Air Asia economy flights, but sit and drink Champagne in the business lounges pretending to work for just 20 quid a pop.

Final thoughts on my Curve Card Review

I hope my Curve card review helped you guys. If you’re sold (and you should be, check out the reviews online if you don’t believe me), then take your free FIVER and sign up here.

There are a few things that improve modern society when it comes to banking. Especially UK or EU citizens who work remotely these days. Finally being able to send money to Thailand, and around the world cheaply without the banks stealing from you, easily cancellable, cheap and easy digital nomad insurance that you can pay monthly and pause when you don’t need it, and now, FINALLY, consolidating your credit cards, debit cards, and loyalty cards into one card with the Curve card.

It’s so good to no longer have a wad of cards in your wallet. That combined with the lounge access stuff, the insurance etc. It’s a game-changer. And if you don’t believe me? Use the standard Curve membership, it’s free! But Metal is where it’s at, believe me. Enjoy!

Remember, never travel without travel insurance! And never overpay for travel insurance!

I use HeyMondo. You get INSTANT quotes. Super cheap, they actually pay out, AND they cover almost everywhere, where most insurance companies don't (even places like Central African Republic etc!). You can sign-up here. PS You even get 5% off if you use MY LINK! You can even sign up if you're already overseas and traveling, pretty cool.

Also, if you want to start a blog...I CAN HELP YOU!

Also, if you want to start a blog, and start to change your life, I'd love to help you! Email me on johnny@onestep4ward.com. In the meantime, check out my super easy blog post on how to start a travel blog in under 30 minutes, here! And if you just want to get cracking, use BlueHost at a discount, through me.

Also, (if you're like me, and awful with tech-stuff) email me and my team can get a blog up and running for you, designed and everything, for $699 - email johnny@onestep4ward.com to get started.

Do you work remotely? Are you a digital nomad/blogger etc? You need to be insured too.

I use SafetyWing for my digital nomad insurance. It covers me while I live overseas. It's just $10 a week, and it's amazing! No upfront fees, you just pay week by week, and you can sign up just for a week if you want, then switch it off and on whenever. You can read my review here, and you can sign-up here!

As you know, blogging changed my life. I left Ireland broke, with no plan, with just a one-way ticket to Thailand

and no money. Since then, I started a blog, then a digital media company, I've made

more than $1,500,000 USD, bought 4 properties and visited (almost) every country in the world. And I did it all from my laptop as I

travel the world and live my dream. I talk about how I did it, and how you can do it too, in my COMPLETELY FREE

Ebook, all 20,000

words or so. Just finish the process by putting in your email below and I'll mail it right out to you immediately. No spam ever too, I promise!

As you know, blogging changed my life. I left Ireland broke, with no plan, with just a one-way ticket to Thailand

and no money. Since then, I started a blog, then a digital media company, I've made

more than $1,500,000 USD, bought 4 properties and visited (almost) every country in the world. And I did it all from my laptop as I

travel the world and live my dream. I talk about how I did it, and how you can do it too, in my COMPLETELY FREE

Ebook, all 20,000

words or so. Just finish the process by putting in your email below and I'll mail it right out to you immediately. No spam ever too, I promise!