What are the (new) Seven Wonders of the World?

So you’re wondering what are the seven wonders of the world, right? You’ve probably heard the term mentioned before, but can you name them? Possibly not. It’s a little confusing. Do you mean the seven manmade wonders of the world? The 7 ancient wonders of the world? The seven natural wonders of the world? I have been lucky enough to visit them all, so let’s have a look.

Normally when people talk about the seven wonders of the world though, they mean the list with the Taj Mahal, the Great Wall of China, Petra, etc. And that’s what you’re looking for too, right? That is also referred to as the SEVEN MODERN WONDERS of the world, or the SEVEN MAN-MADE WONDERS of the world

The original 7 wonders list has changed a lot since its inception during the Hellenic era and since 2007 we have a new set of modern-day wonders of man-made construction. So let’s check out what they are, where they are and you can start planning on how you guys can make it to them all too.

TLDR? This list in the blog post below is the 7 wonders of the world, if you’re looking for the 7 ancient wonders of the world, check that here (that’s the one with the Hanging Gardens of Babylon etc). Equally, if you’re looking for the 7 natural wonders of the world, check that here (that’s the one with Mount Everest, and the Great Barrier Reef etc)

One of the 7 Man-Made Wonders of the World right here in all its glory. The Taj Mahal, Agra, India….

Table of contents

- What are the (new) Seven Wonders of the World?

- So, What are the Seven Wonders of the world?

- 7. Chichen Itza, Yucatan, Mexico

- 5. The Colosseum, Rome, Italy:

- 4. Great Wall of China, Everywhere!, China:

- 3. Machu Pichu, Cuzco, Peru:

- 2. Petra, Wadi Musa, Jordan:

- 1. Taj Mahal, Agra, India:

- Are the Pyramids in Egypt a Wonder of the World? No!

So, What are the Seven Wonders of the world?

7. Chichen Itza, Yucatan, Mexico

In the Yucatan peninsula of Mexico lies one of the greatest archaeological sites of the Mayan civilization, Chichen Itza. The vast site was constructed in around 400 AD and features some incredible sculptures and display which help us to better understand the Mayan culture.

The centerpiece of the site is ‘El Castillo’ a near-perfectly preserved pyramid that was used to worship the sun gods and features ornate serpent sculptures on its four sides. This once-major powerhouse of the Mayan people was way ahead of its time in terms of construction and this can be seen when you visit the incredible site. So what are the seven wonders of the world? Well, Chichen Itza is number 7.

TOP-TIP: It’s super easy to visit from Cancun. You can read about all about getting to Chichen Itza from Cancun, about Ik Kil Cenote and a side trip to Merida in my blog post here.

6. Christ the Redeemer, Rio De Janeiro, Brazil:

The glorious Christ the Redeemer statue in Rio de Janeiro is an iconic mark of human construction and design. The statue depicts Jesus Christ with arms outspread and sits on top of the Corcovado mountain looking over the entire city. Christ the Redeemer was built by Brazilian engineer Heitor da Silva Costa and designed by French sculptor Paul Landowski between 1922 and 1931.

The statue stands at a dizzying 98 feet and the arms outstretched measure 92 feet. This impressive statue has become an iconic symbol of Brazil. So what are the seven wonders of the world? Well, Christ the Redeemer is number 6!

Read about HOW to visit the Christ the Redeemer statue from my time in Rio de Janeiro here!

5. The Colosseum, Rome, Italy:

The biggest amphitheater ever built is the Colosseum in Italy’s capital Rome. During the days of the Roman Empire, this theater would be used to for public displays and gladiator contests where up to 80,000 people would pack themselves into the Colosseum to come and watch.

Throughout the years the Colosseum has seen a great deal of damage and it is no longer functional and around 25% of it has been destroyed. In spite of the damage, the giant theater is still an impressive site and attracts millions of tourists each year. So what are the seven wonders of the world? Well, the Colosseum is number 5!

Check out how to skip the queue and have the best Colosseum experience learned from my time there!

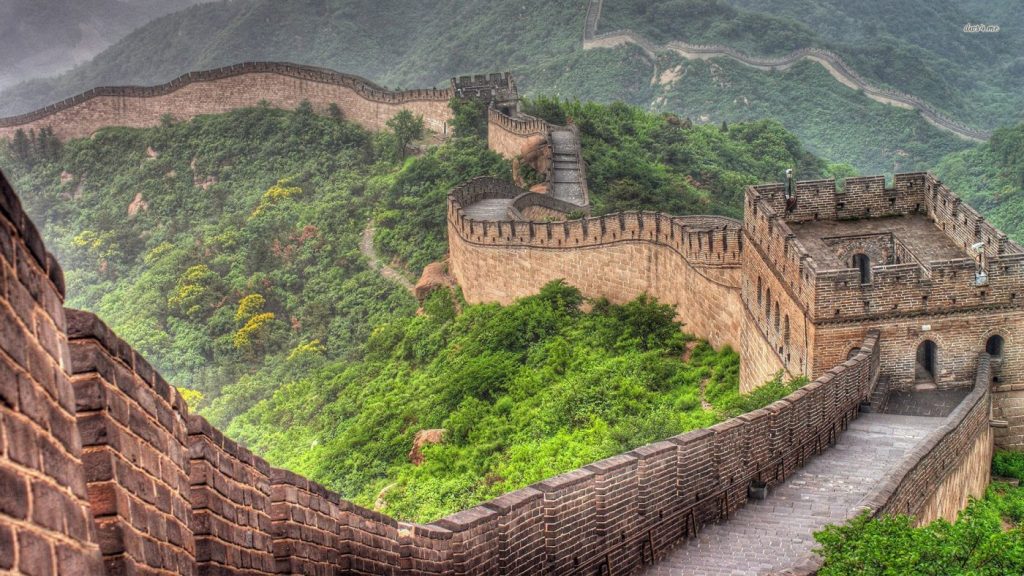

4. Great Wall of China, Everywhere!, China:

Over 4000 miles and almost a thousand years in the making, the Great Wall is pretty damn great to be perfectly honest. You can access the Great Wall via a day trip from Beijing, where the Chinese have done everything in their power to trivialize the whole thing by building a toboggan track down the thing!

Venture further west and you can see some of the untouched Great Wall, perhaps not so well kept, but much more genuine. So what are the seven wonders of the world? Well, the Great Wall of China is number 4!

I visited the Great Wall of China from Beijing, check out how in my blog post here

3. Machu Pichu, Cuzco, Peru:

In Peru’s Cusco Valley lies the ancient Inca citadel of Machu Picchu. It’s an impressive display of human engineering built during the 15th Century under the rule of emperor Pachacuti. The city lies in a dramatic setting above the Sacred Valley, surrounded by green and rocky mountains.

Some of the city has been reconstructed by professional historians to give an impression to tourists of how the city once looked but much of it is still the same dry-stone that was put there by the Incas. The city is intricate and offers archaeologists a near-perfect insight into the Inca world. So what are the seven wonders of the world? Well, Machu Picchu is number 3!

2. Petra, Wadi Musa, Jordan:

Petra is one of the 7 new wonders of the world and it’s easy to see why. The actual site is huge and intricately designed, the Arab Nabataeans were masters when it came to carving and the city features great halls and passageways, tombs, statues, homes and centers for religious practices.

It can, though, be difficult to work out just how to visit Petra in Jordan as there are so many options available. I personally did it independently and would hugely recommend that to any and everyone. Working on your own timetable is perfect! So what are the seven wonders of the world? Well, Petra is number 6!

1. Taj Mahal, Agra, India:

The Taj was built as a mausoleum where the Mughal Emperor Shah Jahan was to bury his wife Mumtaz Mahal. The construction of the Taj Mahal began in 1632 and was not completed until 1653 and the Emperor was due to build a mirror image in black marble for his own mausoleum but after nearly bankrupting his people the first time round, he gave that one a miss.

Good shout Shah. So what are the seven wonders of the world? Well, the Taj Mahal is number 1!

Are the Pyramids in Egypt a Wonder of the World? No!

The Pyramids aren’t one of the seven (new man-made) wonders of the world. But the Great Pyramid is the only remaining original 7 Wonders of the Ancient World!

As a compromise, the Great Pyramid is considered to be the “Honorary Candidate” after the 7 modern wonders of the world and having been there last year I’m gutted that they got the boot. So I’ve sort of included them here!

Remember, never travel without travel insurance! And never overpay for travel insurance!

I use HeyMondo. You get INSTANT quotes. Super cheap, they actually pay out, AND they cover almost everywhere, where most insurance companies don't (even places like Central African Republic etc!). You can sign-up here. PS You even get 5% off if you use MY LINK! You can even sign up if you're already overseas and traveling, pretty cool.

Also, if you want to start a blog...I CAN HELP YOU!

Also, if you want to start a blog, and start to change your life, I'd love to help you! Email me on johnny@onestep4ward.com. In the meantime, check out my super easy blog post on how to start a travel blog in under 30 minutes, here! And if you just want to get cracking, use BlueHost at a discount, through me.

Also, (if you're like me, and awful with tech-stuff) email me and my team can get a blog up and running for you, designed and everything, for $699 - email johnny@onestep4ward.com to get started.

Do you work remotely? Are you a digital nomad/blogger etc? You need to be insured too.

I use SafetyWing for my digital nomad insurance. It covers me while I live overseas. It's just $10 a week, and it's amazing! No upfront fees, you just pay week by week, and you can sign up just for a week if you want, then switch it off and on whenever. You can read my review here, and you can sign-up here!

As you know, blogging changed my life. I left Ireland broke, with no plan, with just a one-way ticket to Thailand

and no money. Since then, I started a blog, then a digital media company, I've made

more than $1,500,000 USD, bought 4 properties and visited (almost) every country in the world. And I did it all from my laptop as I

travel the world and live my dream. I talk about how I did it, and how you can do it too, in my COMPLETELY FREE

Ebook, all 20,000

words or so. Just finish the process by putting in your email below and I'll mail it right out to you immediately. No spam ever too, I promise!

As you know, blogging changed my life. I left Ireland broke, with no plan, with just a one-way ticket to Thailand

and no money. Since then, I started a blog, then a digital media company, I've made

more than $1,500,000 USD, bought 4 properties and visited (almost) every country in the world. And I did it all from my laptop as I

travel the world and live my dream. I talk about how I did it, and how you can do it too, in my COMPLETELY FREE

Ebook, all 20,000

words or so. Just finish the process by putting in your email below and I'll mail it right out to you immediately. No spam ever too, I promise!