SafetyWing Nomad Health Review; Health Insurance for Expats, Nomads and Long-Term Travelers

Long story short? SafetyWing have a new product which gives people who lives overseas PROPER global health insurance. Not travel insurance. Actual health insurance! Brilliant! Check out my SafetyWing Nomad Health review below for all the details…

We all need health insurance, believe me

I’ve blogged it before, but in my 20s, and half of my 30s, I had NO travel insurance. Malaria in Burkina Faso, broken leg in Thailand, snapped ankle in Korea etc etc. I was a broke backpacker, and I couldn’t afford these mishaps. They nearly broke me and sent me back to Ireland.

Eventually, I did some research, and finally a company made it affordable, and easily cancellable, and you pay on a 4-weekly basis (rather than a huge up-front chunk like the others). That company is SafetyWing. I blogged about how they’re the best travel medical insurance for digital nomads and travelers HERE.

But ‘travel insurance’ doesn’t cut it when you LIVE overseas for periods at a time

But I now LIVE in Thailand. I still travel to 20, 30, 40 countries a year but my permanent base is in Chiang Mai, Thailand.

And i know so many online entrepreneurs, bloggers, youtubers etc who are in the same boat. The world may still call us digital nomads, but it’s not accurate. We have a base. So where do we fall in terms of health insurance? Nowhere is the answer. Well, that used to be the answer.

Finally we have an option, and it’s sexy AF. SafetyWing have created a 2nd product, in addition to their normal travel medical insurance, for people like us. Who live overseas, may have weird visa situations. It’s a a full fledged GLOBAL health insurance that covers your medical needs worldwide, including in your home country. Now I can use the hospitals, clinics, physios etc again without paying every time, just like back home. Finally. You can check it out HERE, it’s a gamechanger.

Table of contents

- SafetyWing Nomad Health Review; Health Insurance for Expats, Nomads and Long-Term Travelers

- What is Nomad Health? The Best Health Insurance for Digital Nomads

- How is Nomad Health Different from Normal SafetyWing Travel Insurance?

- Who is Nomad Health For?

- Here’s what’s covered under Nomad Health:

- How Much is Nomad Health?

- How do you sign up, or find out more about, SafetyWing Nomad Health?

- My final thoughts on the SafetyWing Nomad Health Review

What is Nomad Health? The Best Health Insurance for Digital Nomads

In a nutshell, it’s global health insurance. health check-ups? It’s on SafetyWing. Pregant? You’re covered. Physio? All good. God forbid, anything serious (cancer, HIV etc, all covered too, for the rest of your life)

Nomad Health isn’t travel insurance. It’s a comprehensive health insurance solution for digital nomads, remote workers, and long-term travelers. Imagine having the kind of health insurance you’d have at home, but available globally. That’s what Nomad Health is. It covers routine visits, preventive care, and those unexpected emergencies that can happen when you’re living on the other side of the planet.

Check out the pricing here: https://safetywing.com/nomad-health?referenceID=24738558/

How is Nomad Health Different from Normal SafetyWing Travel Insurance?

Travel insurance is for emergencies. You in Thailand, and you get hit by a scooter, or something steels your laptop! Nomad Health is different.

If you’re familiar with SafetyWing’s Nomad Insurance, it’s perfect for covering you if you break a leg, lose your luggage, or get caught in a natural disaster. But Nomad Health takes it a step further by covering both emergency and regular medical care.

Here’s a quick comparison between their travel insurance and their global nomad health insurance:

- Age Limit: Nomad Health covers up to age 74, while Nomad Insurance covers up to age 69.

- Deductible: Nomad Health has no deductible, compared to the $250 USD deductible with Nomad Insurance for US citizens (the rest of us have no deductible here either, yay!)

- Home Country Coverage: Included in Nomad Health, costs extra with Nomad Insurance.

- Annual Policy Limit: $1,500,000 with Nomad Health vs. $250,000 with Nomad Insurance.

- Eligibility: US residents aren’t eligible for Nomad Health at this time.

One thing to note is that Nomad Health requires an application process. This means the insurance team reviews your medical history and any pre-existing conditions before approval. While this might screen out some applicants, it ensures that those who do get approved receive comprehensive coverage.

Who is Nomad Health For?

It’s PERFECT if you are a digital nomad, an expat, or long-term traveler, like me. And pretty much everyone i know living in Thailand, Portugal, Mexico, Bali etc. you’re planning to be away for a year plus, Nomad Health is the way to go. It’s designed for digital nomads, expats, and long-term travelers who need comprehensive health coverage for both emergencies and routine care.

Nomad Health is honestly perfect for digital nomads

- First off, there’s no fixed address requirement. As a nomad, you’re constantly on the move, and the last thing you need is to be tied down by an insurance policy that insists on a permanent address. Nomad Health gets it – you’re a citizen of the world.

- YOU CAN GO PRIVATE IN YOUR OWN COUNTRY TOO! Since coverage in your country of residency is also available for Nomad Health, it’s also a good fit for remote workers who would like to access private healthcare in their country of residence, even if they’re not traveling.

- Second, you can purchase and manage your plan online with ease. Whether you’re lounging on a beach in Thailand or trekking through the mountains in Peru, you can handle everything from your laptop or phone. The interface is super user-friendly, making it a breeze to keep your insurance up to date.

- Finally, they offer a pay-as-you-go option. Our lives are crazy, so you can pay monthly. No need for upfront chunks.

Nomad Health is designed with our lifestyle in mind. It’s affordable, flexible, and reliable – everything you need to stay covered while you explore the world. Stay safe, stay covered, and keep chasing those adventures! Safe travels, everyone!

Who is Nomad Health NOT for?

If you’re going on holiday for a couple of weeks, or even if you’re going backpacking around South East Asia and Australia for 6 months, you don’t need Nomad Health. In cases like this, you should use the standard SafetyWing Travel Insurance ($10 a week!). Nomad Health is for long-term travelers, or people living in other countries for long periods.

Here’s what’s covered under Nomad Health:

At more than $100 a month, you need to know it’s worth it. And it is. So, what are you getting for your money? With your SafetyWing Nomad Health plan, you covered for (and will get a full refund for):

- Emergency Coverage: Up to $1.5 million annually.

- Routine Visits and Preventive Care: Including dental, vision, and vaccines.

- Maternity Care: Up to $4,500 USD.

- Hospital treatment and accommodation

- Inpatient surgery

- Reconstructive surgery

- ICU treatment

- Cancer-related treatments and tests

- Organ transplants

- Evacuation

- Repatriation

Some other benefits:

- Up to $500,000 in rehab and specialized treatments

- Up to $1,000 in durable medical equipment

- Up to $5,000 towards up to 10 outpatient psychiatric visits

- Up to $1,000 in external prosthesis

How Much is Nomad Health?

Nomad Health starts at $133 a month. And goes up to $500+ depending on your age. 99.9% of people reading this though, it’ll be under $200 a month. Which is AMAZING value for proper health insurance. US insurance can reach $1k a month easily. So to have global health insurance, covering you in over 190 countries, is wildly impressive.

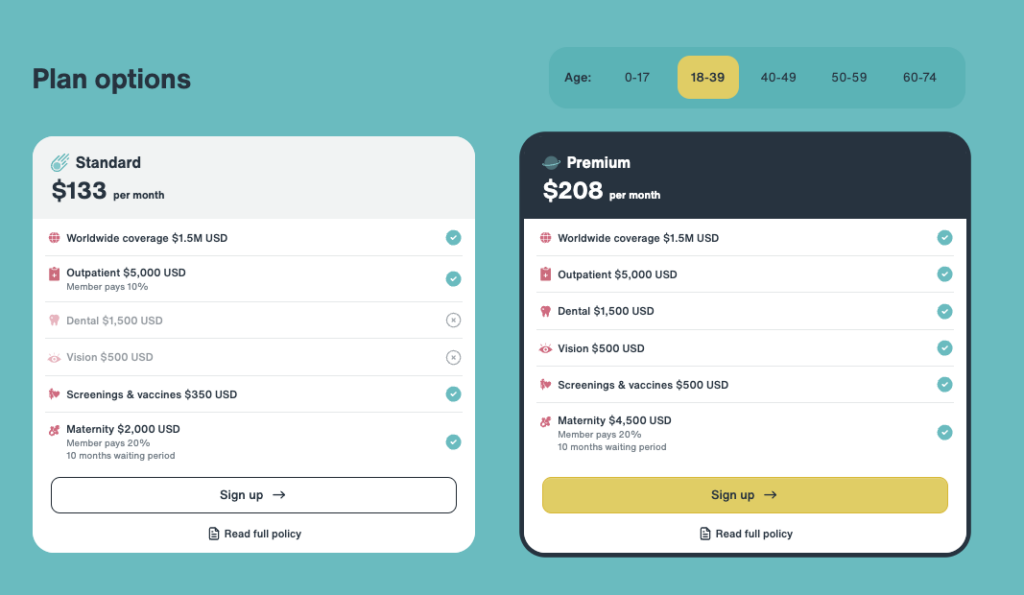

For travelers aged 18-39, the Standard Nomad Health plan costs around $133 USD per month. The Premium Plan, which offers more extensive coverage, is about $208 USD per month. Prices increase with age, so the highest monthly fee is for travelers aged 60-74, costing $569 USD per month for the Standard Plan. While this might seem steep, it’s actually quite competitive compared to other options and much cheaper than paying out of pocket for medical expenses abroad.

To get a personalized quote, check out the SafetyWing website and see what plan fits your needs best.

Which tier is for you? Standard or Premium?

Standard and Premium. Personally I believe Standard is the way to go. But if you’re company is going to pay for you, go Premium of course!

Premium covers dental and vision, where standard doesn’t. And maternity is up to $4500, rather than $2k with standard. Other than that, both plans are very similar.

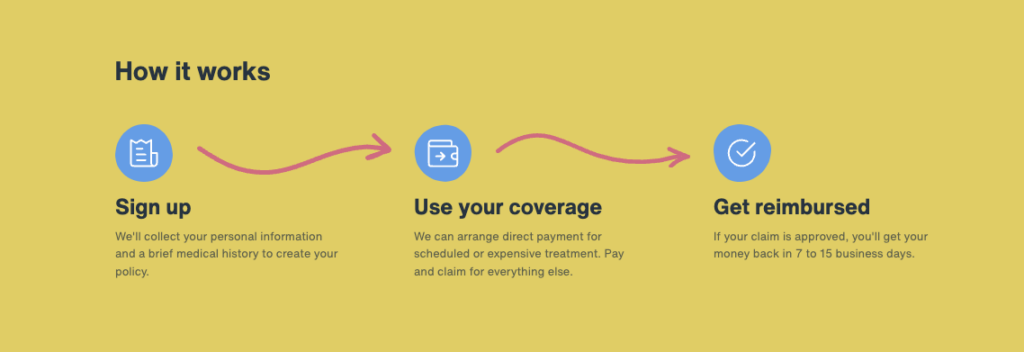

How do you sign up, or find out more about, SafetyWing Nomad Health?

Go here: https://safetywing.com/nomad-health?referenceID=24738558/

If you want REAL health insurance, it’s an absolute winner. Cheaper than pretty much everyone, covered up to $1.5m a year which is better than pretty much everyone. You can buy it when you’re already traveling or living overseas. You pay monthly. It’s a game changer. Check it out HERE.

My final thoughts on the SafetyWing Nomad Health Review

FINALLY, we can have REAL insurance as foreigners living overseas. It’s simply, it’s affordable and it works. I know, health insurance might seem like an unnecessary cost, but it’s an expense worth paying for. Don’t be cheap with your health. Stay covered and stay safe. You won’t regret it. Safe travels, everyone! For more details and to get a quote, head over to SafetyWing and check out their Nomad Health product.

Remember, never travel without travel insurance! And never overpay for travel insurance!

I use HeyMondo. You get INSTANT quotes. Super cheap, they actually pay out, AND they cover almost everywhere, where most insurance companies don't (even places like Central African Republic etc!). You can sign-up here. PS You even get 5% off if you use MY LINK! You can even sign up if you're already overseas and traveling, pretty cool.

Also, if you want to start a blog...I CAN HELP YOU!

Also, if you want to start a blog, and start to change your life, I'd love to help you! Email me on johnny@onestep4ward.com. In the meantime, check out my super easy blog post on how to start a travel blog in under 30 minutes, here! And if you just want to get cracking, use BlueHost at a discount, through me.

Also, (if you're like me, and awful with tech-stuff) email me and my team can get a blog up and running for you, designed and everything, for $699 - email johnny@onestep4ward.com to get started.

Do you work remotely? Are you a digital nomad/blogger etc? You need to be insured too.

I use SafetyWing for my digital nomad insurance. It covers me while I live overseas. It's just $10 a week, and it's amazing! No upfront fees, you just pay week by week, and you can sign up just for a week if you want, then switch it off and on whenever. You can read my review here, and you can sign-up here!

As you know, blogging changed my life. I left Ireland broke, with no plan, with just a one-way ticket to Thailand

and no money. Since then, I started a blog, then a digital media company, I've made

more than $1,500,000 USD, bought 4 properties and visited (almost) every country in the world. And I did it all from my laptop as I

travel the world and live my dream. I talk about how I did it, and how you can do it too, in my COMPLETELY FREE

Ebook, all 20,000

words or so. Just finish the process by putting in your email below and I'll mail it right out to you immediately. No spam ever too, I promise!

As you know, blogging changed my life. I left Ireland broke, with no plan, with just a one-way ticket to Thailand

and no money. Since then, I started a blog, then a digital media company, I've made

more than $1,500,000 USD, bought 4 properties and visited (almost) every country in the world. And I did it all from my laptop as I

travel the world and live my dream. I talk about how I did it, and how you can do it too, in my COMPLETELY FREE

Ebook, all 20,000

words or so. Just finish the process by putting in your email below and I'll mail it right out to you immediately. No spam ever too, I promise!