Wise Multi Currency Account Review (formerly Transferwise Borderless Account Review). How It Works!

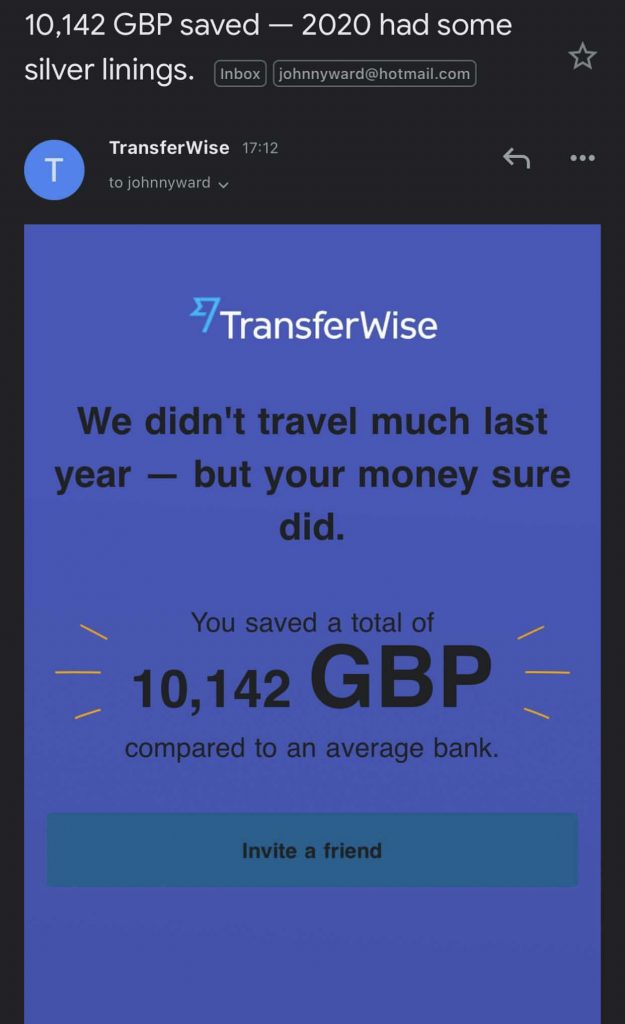

UPDATE MARCH 2022. My Wise multi currency account saved me more than $10,000 USD in the last year alone (it used to be called a transferwise borderless account, but they rebranded as ‘Wise’ in 2021). The blog post will hopefully show you why EVERY SINGLE person who lives in a foreign country, or will travel to one on holiday, or anyone who ever needs to send money internationally, should have a wise multi currency account. So basically every single person.

It’s single-handedly the biggest and best revolution in managing money when you need to send money, or when want to spend money in another country. It’s completely changed the game and has meant that the days of banks charging crazy fees, and giving awful exchange rates, are OVER!

So yeah, you can send money internationally at a fair rate, spend money on your Wise card in foreign countries at a fair rate and not have to deal with extortionate banks in your home country for this stuff anymore.

The main benefit to having a Wise account, over a traditional bank account, is being able to manage your money without borders — without international transaction fees or outrageous exchange rates. You’ll always get the real exchange rate and low fees with Wise.

Table of contents

- Wise Multi Currency Account Review (formerly Transferwise Borderless Account Review). How It Works!

- What is Wise (formerly Transferwise)

- Who should use Wise? And a Wise Multi Currency Account?

- How much does it cost to use Wise?

- Can any nationality have a Wise account?

- How much is a Wise Multi Currency Account?

- How Does Wise Work When You Send Money?

- So I send money to another Wise Acount? Or To A Bank Account?

- How About Receiving Money From Wise?

- What is a Wise Multi Currency Account (formally called a Wise Borderless Account)?

- Wise Gives you a ‘bank account’ in different Currencies

- How do you set up a Wise Multi Currency Account?

- Is the Borderless Account and the Wise multi currency account the same thing then?!

- So is Wise a bank?

- Is it Safe to Send money With Wise?

- Do I need to keep money in my Wise Account?

- I’m OVERSEAS! So I can’t get my Wise Debit Card? How about Apple/Samsung/Google Pay?

- How does Wise compare to Paypal, Western Union or other banks sending money?

- Final thoughts on a Wise Multi Currency Account?

What is Wise (formerly Transferwise)

Wise is a platform that people use to send and receive money internationally at REAL EXCHANGE rates, with SUPER low fees. It’s used by more than 10 million people, in more than 170 countries daily. Personally, I use it weekly in Thailand and beyond.

It was set-up over 10 years ago, by the guys who invented Skype, and now people use it to send more than $1 BILLION dollars a month. It’s massive, and last year it floated on the stock market with a valuation of over $11b!

There are 2 amazing sides to Wise.

A: Sending money internationally at REAL exchange rates

B: Have a Wise multi currency account, and therefore being able to spend money overseas in the local currency!

Who should use Wise? And a Wise Multi Currency Account?

1: Travelers and holiday-makers

WHO? Anyone who will ever go abroad on holiday, or to work (so basically everyone!), should have a Wise Multi Currency Account and the Wise Debit Card that comes with it.

WHY? You can use your Wise Visa Debit card to pay for everything in the foreign country IN THEIR LOCAL CURRENCY, saving a fortune compared to if you use your UK/US/home country card.

Having a wise multi currency account and Wise debit card is AS IF YOU HAD A LOCAL BANK ACCOUNT IN THE COUNTRY YOU’RE IN. Amazing.

2: Anyone sending money

WHO? Anyone who ever needs to send money internationally

WHY? When you send money with Wise, you get the REAL EXCHANGE RATE. Not the awful bank exchange rate that’s been stealing from us for years!

TOP-TIP: If you ever need to send someone money from your home bank account, but you don’t have your card reader with you (pretty much always!), you can bypass the need for the card reader by sending them the money via Wise!

3: Digital Nomads or remote workers

WHO? Every digital nomad and remote worker on the planet.

WHY? Wise borderless accounts let you hold currency in more than 54 currencies. People can pay you into your Wise account in pretty much any currency and you can either then hold that currency, or convert it to the current of the country you’re currently in, or to your home country currency all at the REAL EXCHANGE RATE.

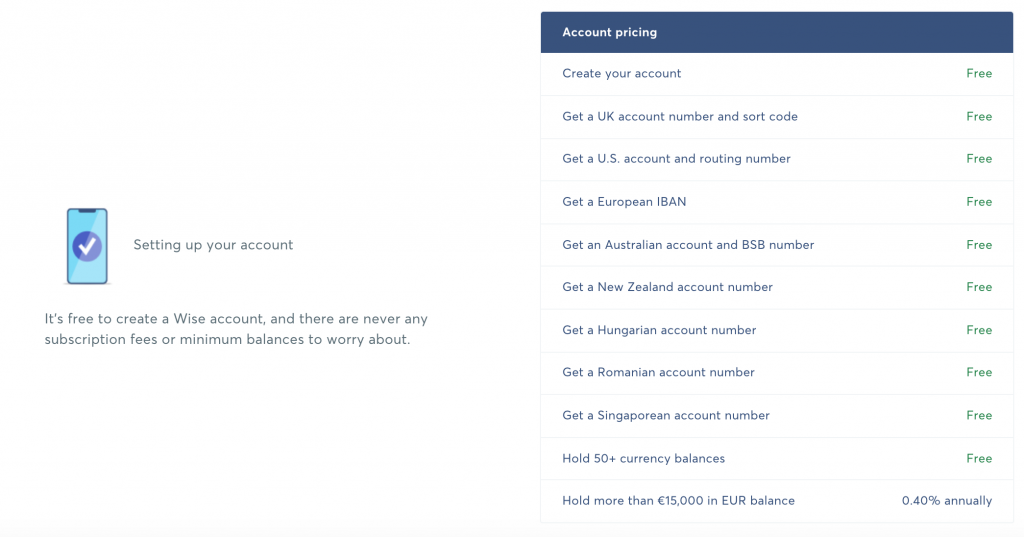

How much does it cost to use Wise?

- To sign up? Free.

- To send money with Wise to a bank account (i.e NOT to another wise account), less than 0.4%.

- To send money from your Wise account to another Wise account in the same currency? Free!

- To send money from your Wise account in 1 currency, to another Wise account in a different currency, less than 0.25%.

Wise is 100% the cheapest way to send money internationally.

Can any nationality have a Wise account?

Yes, any nationality can have a Wise account and send money.

However, the Wise Multi Currency account, and Wise Debit Card, is only open to citizens of:

Europe

Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France (only Metropolitan), Germany, Greece, Hungary, Iceland, Italy, Ireland, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom, Gibraltar (British Overseas Territory) and the UK Crown Dependencies: Guernsey, Isle of Man, and Jersey.

Asia

Singapore and Japan.

Oceania

Australia and New Zealand.

North America

The US

How much is a Wise Multi Currency Account?

It costs 5GBP (7$) for the Wise Debit Card.

This is THE BEST WAY to use your money when you’re overseas, using the Wise Debit Card.

How Does Wise Work When You Send Money?

Imagine you need to send money from Uk to Thailand (for example). Wise is different to traditional banking where banks would spend days sending your actual money from A to B, they’d charge you CRAZY fees AND give you an awful exchange rate.

With Wise you send your money from your account in the UK (for example) to THEIR account ALSO in the UK. So a domestic transfer, which is instant.

Then they (almost) instantly send money from THEIR Thai account to the Thai account where you’re sending money. Another domestic transfer. Genius.

This way you get the real exchange rate, and pay a small fee for the service. It’s amazing!

So I send money to another Wise Acount? Or To A Bank Account?

You can do either.

A: You can use your Wise account to send money to a bank account in another country (that’s how I move money from my UK bank account to my Thai bank account). So the person you’re sending money to doesn’t need a Wise account, they don’t even have to know what a Wise account is! You just need their bank details and you can send it.

B: You can also send money from your Wise Account to another person’s Wise account. So it doesn’t automatically hit their ‘real’ bank. It will appear in their Wise account in whatever currency you sent (USD/GBP/AUD etc).

How About Receiving Money From Wise?

If you don’t have a Wise account, you can still receive money straight into your bank account when someone sends you money.

If you DO have a Wise account, you can accept the money they send into your Wise account and then choose to either keep it in your Wise account, or move it immediately to your bank account. Up to you.

To receive money via Wise then you can either send someone your actual ‘real’ bank details (and it goes straight into your bank) or give them the email address or phone number associated with your Wise account, and the money will go straight into your wise account (in whatever currency the person sent it in).

What is a Wise Multi Currency Account (formally called a Wise Borderless Account)?

After sending & receiving money with Wise became so successful, they created something even more useful – a Wise multi current account complete with a Wise Debit Card.

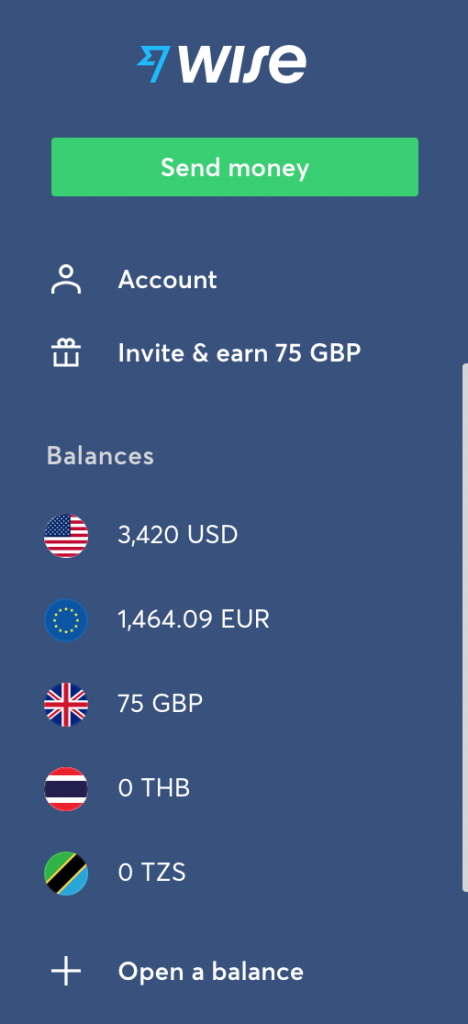

With the Wise multi currency account, you can hold money in your Wise account (as if it was in a bank) BUT you can hold money in 54 different currencies! From Tanzania to Moldova!

Then, with the Wise Debit Card, when you’re in Tanzania or Thailand, or wherever you are, you just hop on the Wise app, send some money to the currency of the country you’re in. Then just use your Wise Visa Debit card in that country, as if it was a local debit card, and you’re billed in the local currency at the REAL EXCHANGE RATE! Any more left over? Send back to GBP/USD or whatever you want. Again, at the REAL EXCHANGE RATE.

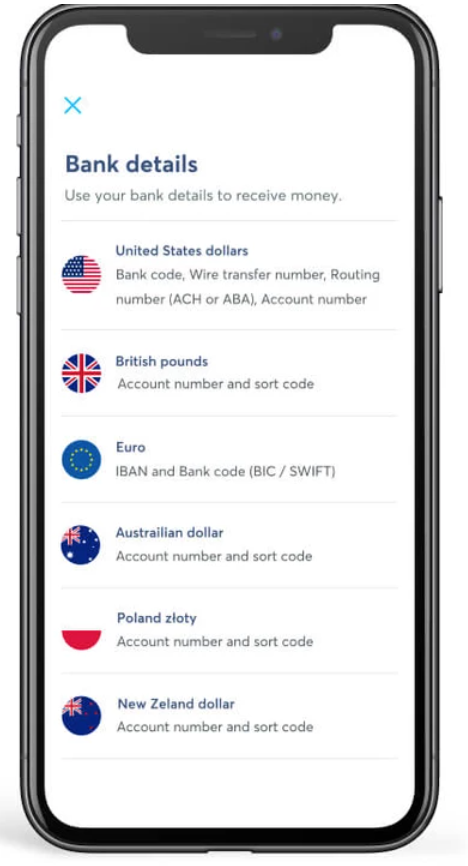

Wise Gives you a ‘bank account’ in different Currencies

With Wise multi currency, you can receive payments in 54 different currencies and hold those currencies, and then spend in them if you want, or switch those currencies back to other currencies, or withdraw it to your bank.

Better still though, Wise gives you bank details in 10 countries where people in those 10 countries can send you money as if you were local. These are the account details you can share with others to receive money. Anyone can use these to pay you just like they’d pay a local.

- GBP

- Euro

- USD

- AUD

- NZD

- SGP

- CAD

- Turkish Lira

- Hungarian Forint

- Romanian Lei

How do you set up a Wise Multi Currency Account?

It takes less than 5 minutes. CLICK HERE to start.

-> Click ‘Multi currency’ at the top.

-> Put in your details, and then you’ll need one piece of ID to upload.

-> Put in your address, and your card will be with you in 3 days!

Is the Borderless Account and the Wise multi currency account the same thing then?!

Yes. The same thing. Since they rebranded from Transferwise to Wise, they also rebranded their account name from the (transfer)Wise Borderless Account to the Wise Multi Currency account

So is Wise a bank?

Nope. It’s not a bank. Banks accept people’s money, then they invest that money and make profit. This means if everyone tried to get all their money out, the bank would go bust. Wise keeps all the money, and it’s there, liquid and waiting for us to use it.

Is it Safe to Send money With Wise?

Yes. Super safe. 10 million people use it each month! They send over $7 billion per month. Wise is regulated by the FCA. They use 2-factor authentication to protect your account. And they hold money with established financial institutions so it’s separate from their own accounts.

Do I need to keep money in my Wise Account?

Nope. In fact, I don’t. Anytime I need to send money, that’s when I send it from my my ‘real’ bank account, to Wiset, and then Wise sends i to either another person’s Wise account, or to a bank account (whichever I chose to send it to)

I’m OVERSEAS! So I can’t get my Wise Debit Card? How about Apple/Samsung/Google Pay?

Yes, you can still sign up and use the digital card, and input it into your Apple pay, or Google or Samsung pay. All good, don’t worry. Even without the physical card.

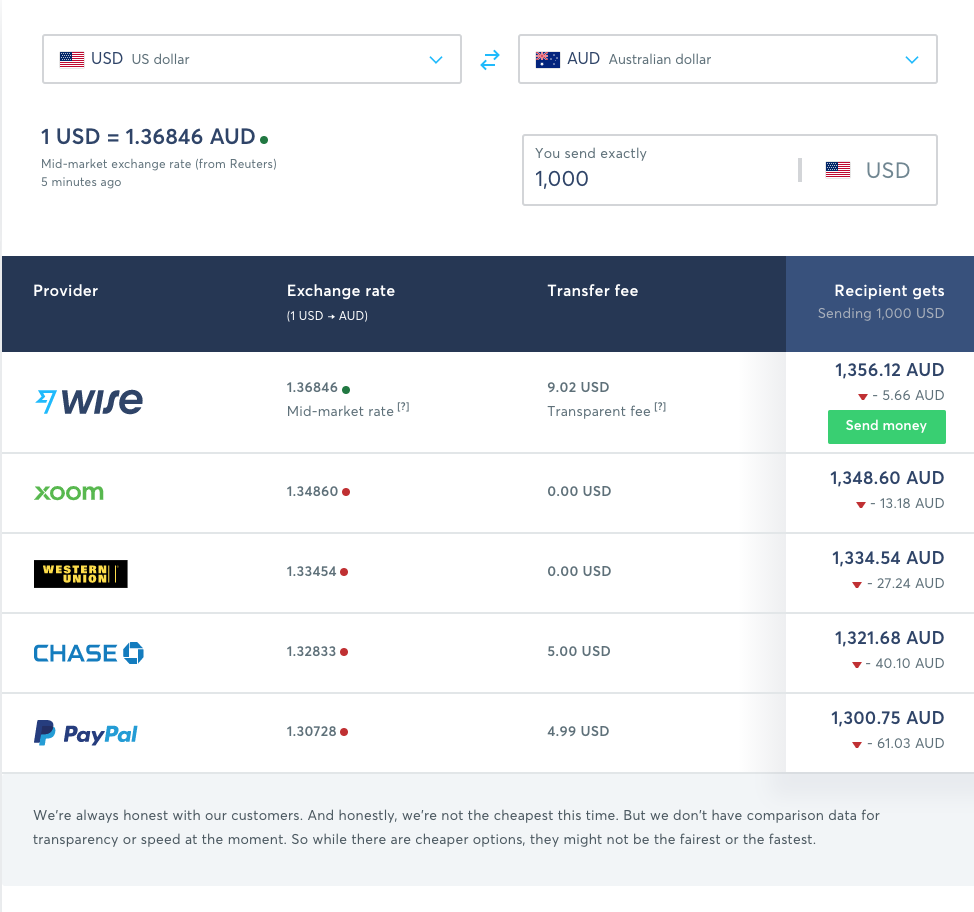

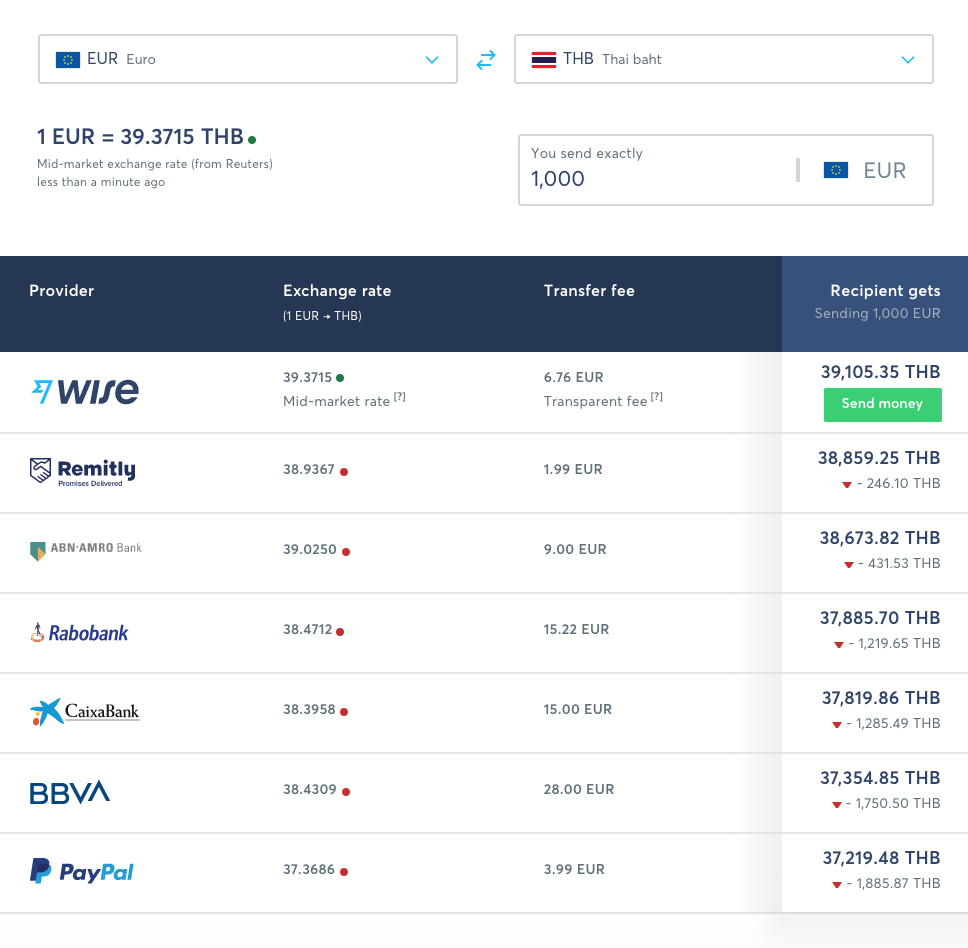

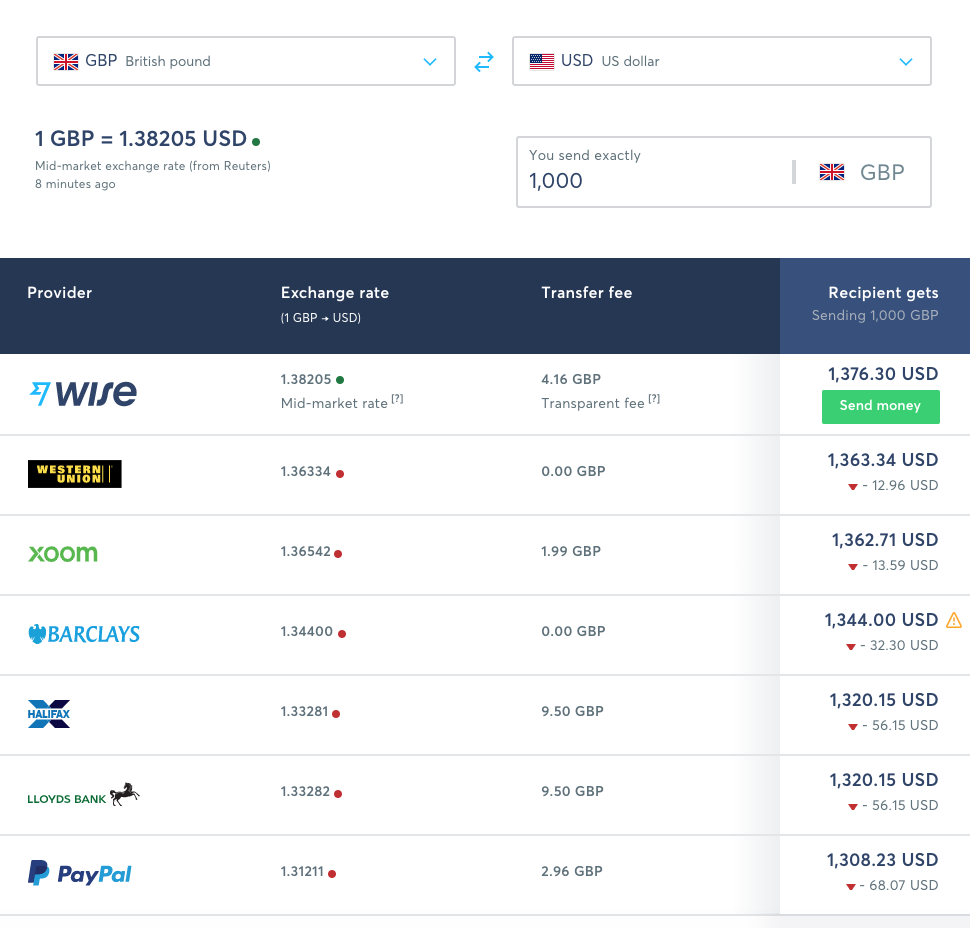

How does Wise compare to Paypal, Western Union or other banks sending money?

If you’re still sending money via Paypal, western union or your traditional bank, you’re an idiot. But fear not, this blog post has finally marked the end of you wasting all your money.

Check out some examples here. EVERY SINGLE TIME Wise is cheaper. Sometimes by $10 , sometimes by hundreds.

Final thoughts on a Wise Multi Currency Account?

This probably comes across like a sponsored advert. It’s not. I’m not affiliated with Wise in any way. Much like my Priority Pass review, I would never ever travel without my Wise Debit Card and Wise multi currency account. Sometimes things come around that change the game, and Wise has done just that.

The bottom line? Everyone should have a Wise account. And everyone should pay the 5GBP for a Wise debit card. No monthly fees, no hidden costs, and it gives you access to different currencies and a card to use overseas.

Even better, here is the first 500GBP you send free too. Sign up HERE.

Remember, never travel without travel insurance! And never overpay for travel insurance!

I use HeyMondo. You get INSTANT quotes. Super cheap, they actually pay out, AND they cover almost everywhere, where most insurance companies don't (even places like Central African Republic etc!). You can sign-up here. PS You even get 5% off if you use MY LINK! You can even sign up if you're already overseas and traveling, pretty cool.

Also, if you want to start a blog...I CAN HELP YOU!

Also, if you want to start a blog, and start to change your life, I'd love to help you! Email me on johnny@onestep4ward.com. In the meantime, check out my super easy blog post on how to start a travel blog in under 30 minutes, here! And if you just want to get cracking, use BlueHost at a discount, through me.

Also, (if you're like me, and awful with tech-stuff) email me and my team can get a blog up and running for you, designed and everything, for $699 - email johnny@onestep4ward.com to get started.

Do you work remotely? Are you a digital nomad/blogger etc? You need to be insured too.

I use SafetyWing for my digital nomad insurance. It covers me while I live overseas. It's just $10 a week, and it's amazing! No upfront fees, you just pay week by week, and you can sign up just for a week if you want, then switch it off and on whenever. You can read my review here, and you can sign-up here!

As you know, blogging changed my life. I left Ireland broke, with no plan, with just a one-way ticket to Thailand

and no money. Since then, I started a blog, then a digital media company, I've made

more than $1,500,000 USD, bought 4 properties and visited (almost) every country in the world. And I did it all from my laptop as I

travel the world and live my dream. I talk about how I did it, and how you can do it too, in my COMPLETELY FREE

Ebook, all 20,000

words or so. Just finish the process by putting in your email below and I'll mail it right out to you immediately. No spam ever too, I promise!

As you know, blogging changed my life. I left Ireland broke, with no plan, with just a one-way ticket to Thailand

and no money. Since then, I started a blog, then a digital media company, I've made

more than $1,500,000 USD, bought 4 properties and visited (almost) every country in the world. And I did it all from my laptop as I

travel the world and live my dream. I talk about how I did it, and how you can do it too, in my COMPLETELY FREE

Ebook, all 20,000

words or so. Just finish the process by putting in your email below and I'll mail it right out to you immediately. No spam ever too, I promise!