How Many Countries in Southeast Asia?

There are 11 countries in Southeast Asia. I already explained how many countries in Asia in this blog post (52 if you count Northern part of Iraq, Tibet etc). And on my personal trip to 197 countries, I figured out how many countries in the world!

When you start to break down the regions of the 7 continents, it can get a little confusing. For example, there are 23 countries in North America, right? But North America, as a continent, actually includes all the countries in the Caribbean (13 countries there). And it’s the same for Asia and Southeast Asia. Anyway, I love this kind of stuff, but let me get back to the issue. How many countries in South East Asia? 11 countries are in South East Asia..

Table of contents

List of countries in Southeast Asia

- Cambodia

- Laos

- Myanmar (Burma)

- Malaysia

- Thailand

- Vietnam

- Brunei

- East Timor

- Indonesia

- Philippines

- Singapore

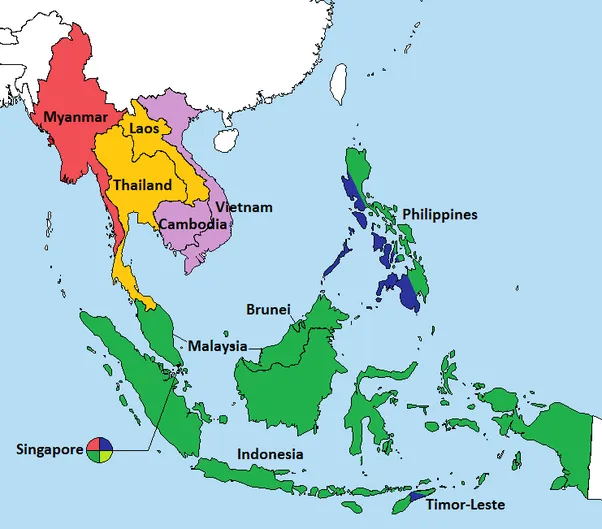

Southeast Asia Countries Map

What about Papua New Guinea? And Christmas Island etc?

There are a couple of places that almost squeeze into the list of countries in Southeast Asia, but not quite.

- Papua New Guinea: An independent country, and one of the 197 countries in the world. PNG takes up half the island of New Guinea. The other half of that island belongs to Indonesia (which is considered a country within SE Asia). However, the island of New Guinea falls within the continent of Australia/Oceania/Australasia. Separated by the Sahul Shelf in terms of tectonic plates below the water. So PNG isn’t part of Southeast Asia, or Asia for that matter.

- Andaman and Nicobar islands: Within the Southeast Asian area, but belongs to India, so therefore not a country.

- Christmas Island: Within the Southeast Asian area, but belongs to Australia, so therefore not a country.

- Cocos (Keeling) island: Within the Southeast Asian area, but belongs to Australia, so therefore not a country.

- Guam: Sometimes considered within the Southeast Asian area, but belongs to the USA, so therefore not a country.

- Palau: An independent country, and one of the 197 countries in the world. But it lies just outside what is considered Southeast Asia.

- Borneo: Is Borneo a country? Nope, it’s the 3rd largest island in the world (after Greenland and New Guinea), but it belongs to 3 countries. Brunei, Malaysia and Indonesia.

FAQs about “how many countries in South East Asia

- Which is the largest country in Southeast Asia by area and population?

- Indonesia is the largest country in Southeast Asia both by land area and population. It is an archipelago comprising thousands of islands and is home to over 270 million people, making it the fourth most populous country in the world.

- Are there any island nations in Southeast Asia?

- Yes, several countries in Southeast Asia are island nations. These include Indonesia, the Philippines, East Timor, and Singapore. Indonesia and the Philippines, in particular, are made up of thousands of islands each.

- How do Southeast Asian countries compare in terms of economic development?

- The economic development among Southeast Asian countries varies widely. Singapore is considered one of the most developed and prosperous countries not just in the region but globally, with a highly advanced economy and high per capita income. On the other hand, countries like Myanmar and Cambodia are among the less economically developed in the region, with economies that are growing but still face significant challenges. The region as a whole is known for its dynamic growth, with many countries experiencing rapid economic development and modernization.

Final thoughts on how many countries in Southeast Asia?

Normally when we talk about how many countries in Europe, South America, North America, Asia, Africa, Antarctica, and Australia, the answers are quite controversial. And they require a lot of political thought. But ‘how many countries in Southeast Asia’ is actually an easy question to answer. There are 11 countries in South East Asia. It’s definitive. Thankfully!

Remember, never travel without travel insurance! And never overpay for travel insurance!

I use HeyMondo. You get INSTANT quotes. Super cheap, they actually pay out, AND they cover almost everywhere, where most insurance companies don't (even places like Central African Republic etc!). You can sign-up here. PS You even get 5% off if you use MY LINK! You can even sign up if you're already overseas and traveling, pretty cool.

Also, if you want to start a blog...I CAN HELP YOU!

Also, if you want to start a blog, and start to change your life, I'd love to help you! Email me on johnny@onestep4ward.com. In the meantime, check out my super easy blog post on how to start a travel blog in under 30 minutes, here! And if you just want to get cracking, use BlueHost at a discount, through me.

Also, (if you're like me, and awful with tech-stuff) email me and my team can get a blog up and running for you, designed and everything, for $699 - email johnny@onestep4ward.com to get started.

Do you work remotely? Are you a digital nomad/blogger etc? You need to be insured too.

I use SafetyWing for my digital nomad insurance. It covers me while I live overseas. It's just $10 a week, and it's amazing! No upfront fees, you just pay week by week, and you can sign up just for a week if you want, then switch it off and on whenever. You can read my review here, and you can sign-up here!

As you know, blogging changed my life. I left Ireland broke, with no plan, with just a one-way ticket to Thailand

and no money. Since then, I started a blog, then a digital media company, I've made

more than $1,500,000 USD, bought 4 properties and visited (almost) every country in the world. And I did it all from my laptop as I

travel the world and live my dream. I talk about how I did it, and how you can do it too, in my COMPLETELY FREE

Ebook, all 20,000

words or so. Just finish the process by putting in your email below and I'll mail it right out to you immediately. No spam ever too, I promise!

As you know, blogging changed my life. I left Ireland broke, with no plan, with just a one-way ticket to Thailand

and no money. Since then, I started a blog, then a digital media company, I've made

more than $1,500,000 USD, bought 4 properties and visited (almost) every country in the world. And I did it all from my laptop as I

travel the world and live my dream. I talk about how I did it, and how you can do it too, in my COMPLETELY FREE

Ebook, all 20,000

words or so. Just finish the process by putting in your email below and I'll mail it right out to you immediately. No spam ever too, I promise!