How To Invoice As A Freelancer; Xolo Review

I’ve been a digital nomad since quitting my telesales job way back in 2010. Over 10 years ago. And I’ve never looked back. It allowed me to visit every country in the world, to make more than $2m from my blog. But even once you’ve taken the leap and set up as a digital nomad, things can be confusing. How do you invoice as a freelancer? Do you register a business as a digital nomad? How do you pay tax, and to who? Finally though, now there are some solutions. Check out my Xolo Review.

Since I first began in 2010, the digital nomad scene has grown and grown. It’s great to see so many people wanting to take control of their lives. More people are understanding that life means more than a 40+ hour work week and a 2 week holiday to Spain or Mexico. Better still, there are now companies who have stepped in to fill the confusing space when it comes to the boring logistics of being a digital nomad.

Table of contents

- How To Invoice As A Freelancer; Xolo Review

- Who is this article for?

- So How Do You Set-Up Legally as a Digital Nomad?

- How To Set-up Legally As A Digital Nomad; The 6 Step Work Flow:

- Step 1:

- Step 2:

- Step 3: Invoicing your clients as a freelancer; Xolo Review

- Step 4: Registering Your Business (online)

- Step 5:

- Step 6:

- How To Set-UP As A Digital Nomad; XOLO.IO & Invoicing as a freelancer

- WHY use Xolo Go?

- Xolo Go Step-by-Step:

- Why Estonia?

- What’s this about Estonia E-Residency?

- Final thoughts on Invoicing as a freelancer and setting up as a digital nomad?

- Other Digital Nomad, Money & Blogging Stuff

Who is this article for?

For digital nomads, bloggers, influencers, owners of small businesses, solopreneurs, etc who are just starting out, or aren’t bringing in much money yet. This blog will explain how you can send professional invoices, keep money in different currencies, sort out expenses etc all for no start-up cost.

It’s basically how to look as if you have a registered company before you need to deal with having a registered company.

So How Do You Set-Up Legally as a Digital Nomad?

When you first start out, you’re clueless. Me too, don’t worry. Whether you’re a blogger, YouTuber, internet marketer, copywriter or whatever, it’s so confusing as to just how to set up. You hear rumours about people starting companies in Hong Kong, Bahamas, Malta. Bank accounts in Singapore, Cyprus and the Cayman Islands. It’s mad. And if like me, you don’t come from money, it’s so damn confusing. What to do?!

When I started, there was no-one to help. Once I started making decent money, I registered it all in Hong Kong. That’s now pretty impossible to do. And besides, you need to have it set-up right from the outset nowadays. So how do you go about the first few steps in your new digital nomad life?

How To Set-up Legally As A Digital Nomad; The 6 Step Work Flow:

- Start your hustle. Whatever it is. Mine was my blog, then my SEO company, next was my adventure trips and then my non-profit Mudita Adventures. Whatever makes you happy and makes you money. Hopefully both at the same time.

- Be brave. Quit your job. Live wherever you dreamt. Ibiza, Bangkok, Bali, Medellin. Or better yet travel and work at the same time.

- Do your work and invoice your clients.

- Once you’re up and running, register your company.

- Outsource the hard-work, grow.

- Live the dream.

Step 1:

Find your passion. I know online fitness trainers, nutritionists, import/export people, eBay and amazon experts, SEO, Instagram and of course bloggers. Choose your path wisely and get working. If it’s blogging you want to get started with, drop me a line, I can help with some beginner coaching.

Step 2:

The scary part. It’s so comfortable at home. London, New York, Dublin. Wherever you are. You have your friends, your supermarket, your pizza place. But it’s outside your comfort zone that the magic happens. Take the leap of faith and go live your life. (But don’t do it without digital nomad insurance!).

Step 3: Invoicing your clients as a freelancer; Xolo Review

The ACTUAL logistics of being a digital nomad! This is what we’re here for today. You do your work, sell your digital products, or whatever way you make money. Now what? You can’t just say to the client “Ermmm, can you whack the money in my personal account please?”. Well, I guess you kinda can. I did that for years. But it’s so unprofessional. It hurts repeat business. And it stunts your growth. So how do you invoice as a freelancer? What about a business bank account? How about Iban numbers and BIC codes? What about different currencies and clients in other countries?

I’ve got you. Two Words. Xolo Go. Xolo is essentially a middle-man that take care of all that invoicing, international bank accounts, legitimate business expenses, reduce your tax liabilities etc. I wish this was around when I got started. I explain ALL of that below. Scroll down for the explanation, or check if that’s too much work, CLICK HERE to check them out directly. Xolo Go opens a dedicated business bank account for you in the background and you will also receive a VAT number. No set-up cost, and super professional.

Step 4: Registering Your Business (online)

When I was starting, this was a NIGHTMARE. I tried in the UK, Ireland, Thailand and eventually after back and forth to Hong Kong multiple times, I managed it, just about, there. Not anyone. Digital nomad life is on the rise, and there are companies who have stepped in and filled this space and removed the stress.

I’ll do another blog post about this. But the Xolo team offer an AMAZING service here. Xolo Leap (their more expensive product), starting at €79 a month (crazy cheap) sets up:

- Your own officially registered EU company

- Accounting and reporting on your behalf

- Invoice tools so you can invoice all your clients in different currencies

- Take payments via Stripe (credit cards) and Paypal

- Pay salaries to yourself and outsourced staff

- Corporate tax processing

- ALL DONE online. No need to go to Estonia.

NOTE: If you’re just starting out as a blogger, or solopreneur, you don’t need all this company registration stuff just yet. Wait a few months until you have some regular revenue etc. If you’re already up and running though, and you want a real registered company, an EU-registered bank account etc, then go ahead and get started.

Step 5:

Don’t make the same mistakes as me. I used all the money I made and took it as ‘profit’. I should have reinvested the money into my businesses, and I’d probably have tripled my net worth now. Pay yourself a salary. Reinvest the rest into staff and business development.

Step 6:

The dream. Work from your laptop, anywhere in the world, any time of the day you choose. But there are no short-cuts. It’s only available to people who are willing to work for it.

How To Set-UP As A Digital Nomad; XOLO.IO & Invoicing as a freelancer

If you want to freelance and invoice as if you’ve got a company, but don’t want the hassle or cost of having a company, use Xolo Go.

If you want to actually register your own company, have your own bank account but do it ALL online, use Xolo Leap.

What is Xolo?

Xolo helps digital nomads, expats and freelancers to set up and run solo businesses. They save you time and money by making the boring parts of the business like banking, accounting, and tax easy. Their mission is to make starting and running a modern microbusiness 10 times easier. They have 2 basic products – Xolo Go (free to set-up, can invoice clients and manage accounts), and Xolo Leap (includes company registration, bank accounts etc)

XOLO GO or Xolo Leap?

When you first want to invoice as a freelancer, or start researching about how to set-up life as a digital nomad, you’ve probably come across Xolo already. At this point, you have to choose Xolo Go or Xolo Leap. Should you sign up for Xolo Go or Xolo Leap?

If you’re just starting out, choose Xolo Go. If your business is already making money every month, but you haven’t registered a company yet then Xolo Leap is the way. I’m going to focus on Xolo Go in this blog post because it’s the best for beginners on their digital nomad journey

Xolo Go: Invoicing As A Freelancer

Signing up for Xolo Go is free. 100% free to sign up. Once signed up, it allows you to invoice clients as a freelancer using Xolo’s EU company.

This is how it works:

- You’ve just started your blog/YouTube/online biz

- When you need to invoice a client. You don’t want to send them a make-shift sh*tty Microsoft word invoice to your personal bank account.

- You sign up for Xolo Go (for free), register your bank and stuff with them in about 10 minutes. Use their website to do everything, including invoicing.

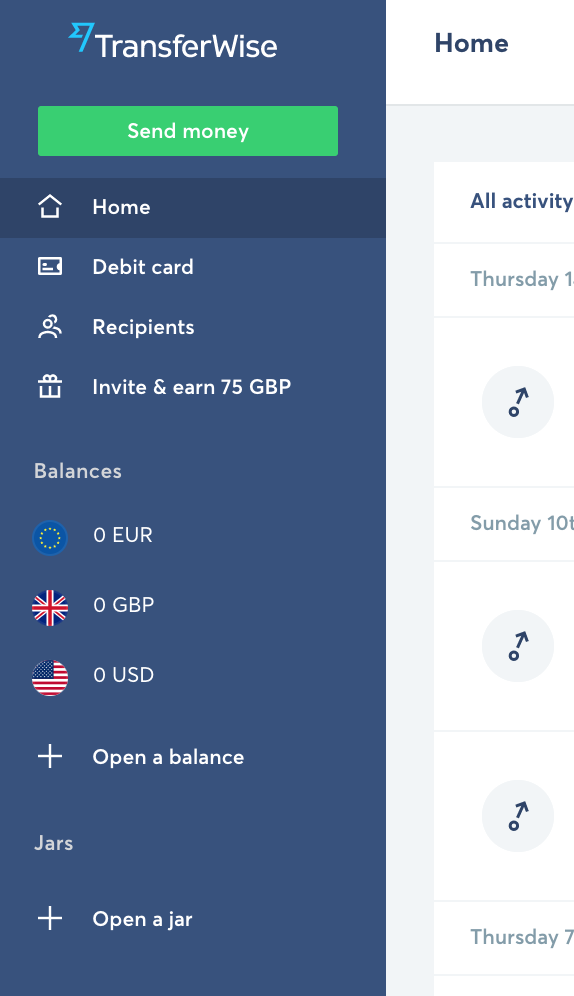

- Invoice your client, you’ll receive your business income to your Xolo business account. You can withdraw it to a personal bank account (or, even better, Transferwise!). Xolo takes 5% as their fee. Done.

- Tax stuff is up to you depending on where you’re based or traveling. Xolo doesn’t withhold any tax. They leave that your responsibility. Perfect!

- *BONUS: As you spend you add the receipts to your Xolo account to make it tax-deductible. Reducing any tax liabilities you have in the future.

WHY use Xolo Go?

The short, simple answer is that it’s free to set-up. You now can invoice clients professionally, using a business bank account (and with a VAT number). You can track ALL your payments. Manage your incoming and outgoings. And ultimately be a professional digital nomad.

The longer answer?

- Official. You’re an individual. But of course, you do your work and now it’s time to get paid. But you don’t have a company or a legal entity from which to invoice your clients or customers. Xolo Go allows you to issue invoices visa their Xolo EU company with a valid EU VAT number. Now your business is conducted officially AND your client can receive an invoice from a company for their accounting. (Your client will always prefer that over receiving an invoice from a private person!).

- No VAT: If both parties are EU VAT payers, you can benefit from the reverse charge mechanism (= 0% VAT).

- All the tools to run your business in one place online. That means a business bank account, income reports, professional invoicing, expense management.

- Reduce your tax: Any costs your business incurs, upload the receipts to your Xolo account, the costs are deducted from your taxable income = more money.

- Credibility: Invoicing via a legal framework gives you as a freelancer more credibility in the eyes of businesses.

- Overdue payments: The Xolo Go dashboard gives a super simple overview of your invoices and whether these are paid on time or are overdue. And allows you to add a late payment interest fee on every invoice.

Xolo Go Step-by-Step:

1 CLICK HERE and sign up for Xolo Go for free.

You fill in your citizenship, your tax residency, the area in which you work. This takes about 3 minutes.

2 BANK DETAILS:

If you have an EU bank account (I don’t), then you simply add your Account Name, IBAN and BIC. If you’re American, Irish or whatever and don’t have an EU bank account. You hope onto your Transferwise account (if you don’t have one, you should click here to sign up and get some free transfer credit with my link). On the left sidebar, click ‘euro’ and you’ll get your transferwise bank details. Put these into your new Xolo account.

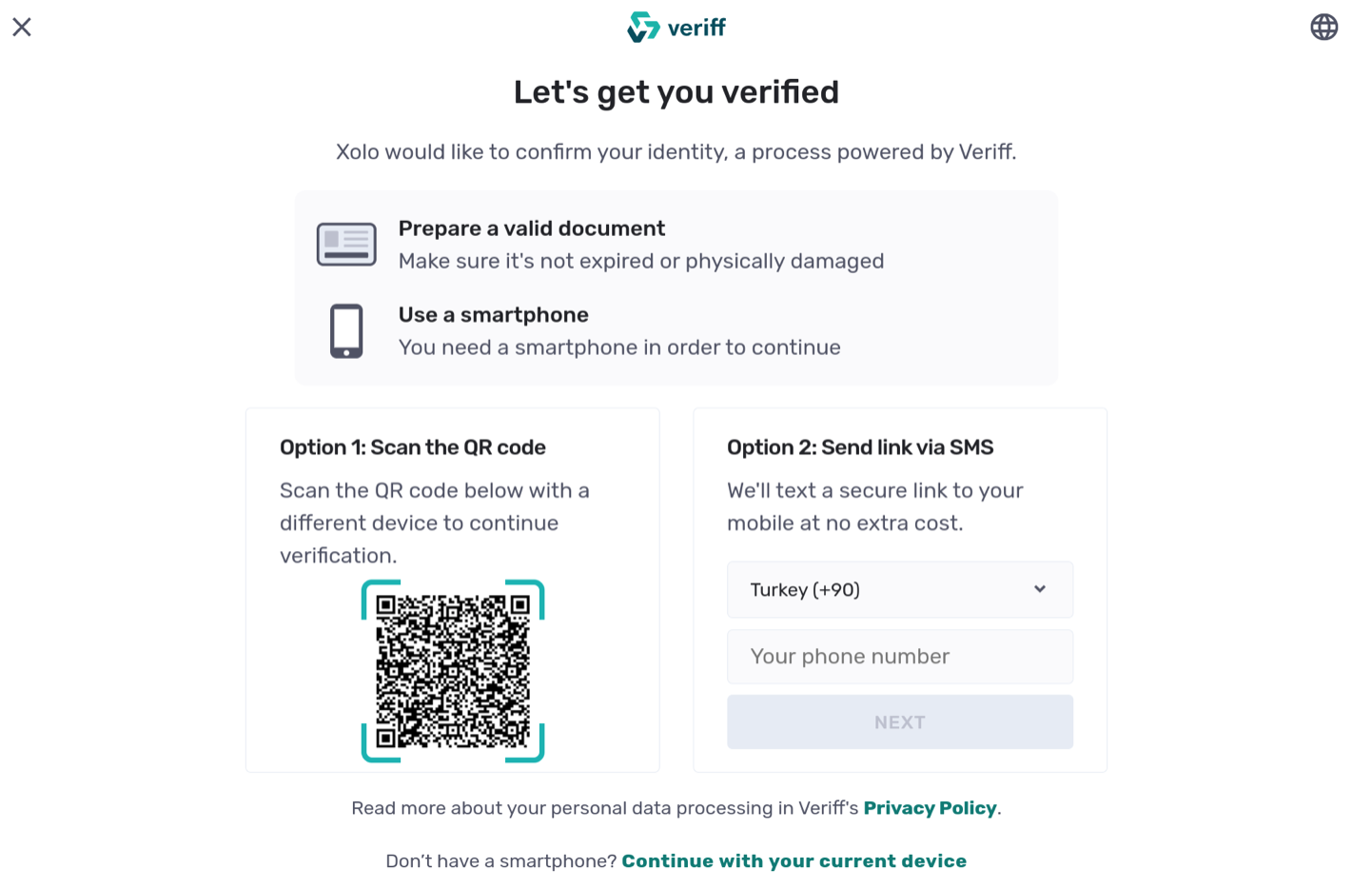

3 VERIFY YOURSELF: You get asked to scan a QR card on your phone, then take a pic of your ID. I used my passport, but you can use your driving license etc too.

3 ACCEPT T&Cs: Accept the terms and conditions

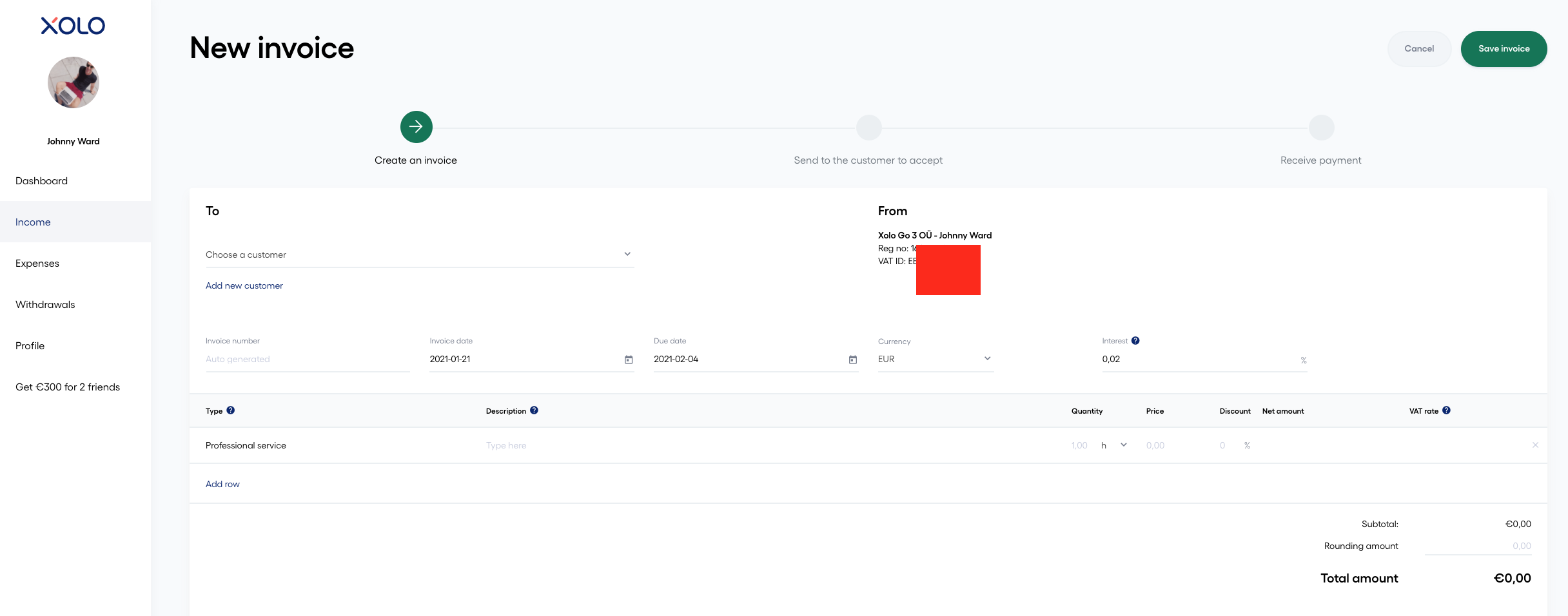

4 INVOICE AS A FREELANCER!

Your account is already set-up and you’re good to go. You can now send professional invoices with a legitimate business, VAT is taken care of and you can upload your expenses. Step 1 on your digital nomad set-up is complete. Now go make some money.

Using their template, you simply click – create a new invoice. And it’s just plug-in and play. SUPER easy, super professional. Your client gets an invoice via email, you get a copy too. You both get emailed when it’s paid, and the money goes straight into your Xolo dashboard. From there you can instantly withdraw it if you want.

Why Estonia?

If you’re a digital nomad, you’ll have been hearing a big buzz about Estonia in the last 5 years or so. Why? Estonia, as a first-world, EU nation, has focused on being a hub for digital companies. Making it financially efficient, and super-easy, to set-up shop.

Although Xolo is a remote company, and you don’t need to be IN Estonia to do any of this. If I was younger, and hopping around the world from place to place, Estonia would be right high on my list of places to base myself for a while as a digital nomad. Such a cool scene there for online people. And Tallinn, the Capital, is gorgeous. And despite being really developed, it’s still really cheap. What a winner.

What’s this about Estonia E-Residency?

And with the buzz of online-vibes around Estonia came Estonia E-Residency. Estonia was the first country in the world to offer something like this. Basically, for a couple of hundred euros, you can apply for Estonia Eresidency. This then gives you permission and access to their banking and bank products. Registering businesses, opening bank accounts, all legally. And without the crazy runaround, I had to do back in the day when I started and ended up in Hong Kong multiple times!

If you choose Xolo Leap, the product that actually registers a business in Estonia on your behalf, and opens an Estonia bank account on your behalf, they ask you to go through the Estonia Eresidency process first.

Final thoughts on Invoicing as a freelancer and setting up as a digital nomad?

Setting up as a digital nomad used to be complicated. Now, not so much. So my advice is first, do Xolo Go (for free) so you can invoice people professionally and get paid. As you grow, then use Xolo Leap to have a fully-fledged registered company, with an accountant etc working on your behalf. Times are changing, and it’s only getting better. Hope my Xolo Review helps!

Other Digital Nomad, Money & Blogging Stuff

How I made $1,000,000 in 3 years blogging

But How Do Bloggers Make Money? & How Much Do Bloggers Make?

How Many Readers Do You Need To Make Money?

Travel Blogger Salary

Digital Nomad Health Insurance

Remember, never travel without travel insurance! And never overpay for travel insurance!

I use HeyMondo. You get INSTANT quotes. Super cheap, they actually pay out, AND they cover almost everywhere, where most insurance companies don't (even places like Central African Republic etc!). You can sign-up here. PS You even get 5% off if you use MY LINK! You can even sign up if you're already overseas and traveling, pretty cool.

Also, if you want to start a blog...I CAN HELP YOU!

Also, if you want to start a blog, and start to change your life, I'd love to help you! Email me on johnny@onestep4ward.com. In the meantime, check out my super easy blog post on how to start a travel blog in under 30 minutes, here! And if you just want to get cracking, use BlueHost at a discount, through me.

Also, (if you're like me, and awful with tech-stuff) email me and my team can get a blog up and running for you, designed and everything, for $699 - email johnny@onestep4ward.com to get started.

Do you work remotely? Are you a digital nomad/blogger etc? You need to be insured too.

I use SafetyWing for my digital nomad insurance. It covers me while I live overseas. It's just $10 a week, and it's amazing! No upfront fees, you just pay week by week, and you can sign up just for a week if you want, then switch it off and on whenever. You can read my review here, and you can sign-up here!

As you know, blogging changed my life. I left Ireland broke, with no plan, with just a one-way ticket to Thailand

and no money. Since then, I started a blog, then a digital media company, I've made

more than $1,500,000 USD, bought 4 properties and visited (almost) every country in the world. And I did it all from my laptop as I

travel the world and live my dream. I talk about how I did it, and how you can do it too, in my COMPLETELY FREE

Ebook, all 20,000

words or so. Just finish the process by putting in your email below and I'll mail it right out to you immediately. No spam ever too, I promise!

As you know, blogging changed my life. I left Ireland broke, with no plan, with just a one-way ticket to Thailand

and no money. Since then, I started a blog, then a digital media company, I've made

more than $1,500,000 USD, bought 4 properties and visited (almost) every country in the world. And I did it all from my laptop as I

travel the world and live my dream. I talk about how I did it, and how you can do it too, in my COMPLETELY FREE

Ebook, all 20,000

words or so. Just finish the process by putting in your email below and I'll mail it right out to you immediately. No spam ever too, I promise!