How many countries in Asia? 47?53?

Technically speaking, there are 47 countries in Asia (50 if you include Azerbaijan, Georgia, and Armenia ‘Asian‘, and not ‘European‘ – which I don’t). It depends on what you call a country, but the answer is somewhere between 46-50 countries in Asia. That depends if you include Tibet, Palestine, and Taiwan as independent nations (as I do). So how many exactly depends on your personal opinion, I explain below.

If you’ve read my article about how many countries are there in the world you’ll understand what constitutes a country, and what doesn’t. If you follow my blog you’ll know that Southeast Asia has been my adopted home for several years, I bought a condo in Bangkok and made Thailand my home. In my journey to every country in the world, visiting all 47 countries in Asia was a little easier for me as it’s my ‘home’ continent’

Asia is by far the largest continent on the planet. It covers the most land with Russia occupying around a third of the region. It also has the biggest population, China (1.42 billion) and India (1.35 billion) pretty much guarantee that they’re always going to be top of the list size-wise.

Table of contents

- How many countries in Asia? 47?53?

- The United Nations Lists 49 countries that are in Asia

- The UN considers the 49 countries above within Asia , but wait!

- Taiwan, Palestine and Hong Kong explained

- Other Territories With Internal Sovereignty in Asia

- FAQs about how many countries are there in Asia:

- Final Thoughts On How Many Countries in Asia

The United Nations Lists 49 countries that are in Asia

As I’ve explained in my ‘every country in the world ‘ article, the UN doesn’t always get the number of countries correct due to their political persuasions. I have listed the 49 countries below. And I’ve then explained why the UN’s list of 49 is different my list of 47 countries in Asia.

It’s a little confusing because both the UN and the real number of countries in Asia differ, but they’re made up of different countries. scroll down below and it will become clear.

The 49 countries the UN considers within Asia:

- Afghanistan (A strange place to take my mum on holiday, BUT I did it, when we travelled to Afghanistan last year!)

- Armenia* (I disagree with the UN here and consider Armenia part of Europe)

- Azerbaijan* (Lots of things to do in Azerbaijan, but it can also be considered part of Europe))

- Bahrain

- Bangladesh

- Bhutan (Home to the Tiger’s Nest Monastery)

- Brunei

- Cambodia

- China

- Cyprus (I disagree with the UN here and consider Cyrpus part of Europe)

- Georgia (I disagree and consider Georgia to be a part of Europe)

- Egypt (I disagree with the UN here and consider Egypt part of Africa)

- India

- Indonesia

- Iran

- Iraq (Travel to Iraq isn’t so common, but it’s a beautiful country)

- Israel

- Japan (I climbed Mount Fuji there with my mum!)

- Jordan (Check out a 1 week itinerary in Jordan)

- Kazakhstan

- Kuwait

- Kyrgyzstan

- Laos

- Lebanon

- Malaysia

- Maldives

- Mongolia

- Myanmar (formerly Burma)

- Nepal

- North Korea

- Oman

- Pakistan

- Philippines

- Qatar

- Russia

- Saudi Arabia

- Singapore (Check ut my 2 day Singapore Itinerary)

- South Korea

- Sri Lanka

- Syria (Travel to Syria is tough, but last year I took a group of my blog readers)

- Tajikistan

- Thailand (Check out my home city, 3 day Bangkok Itinerary)

- Timor-Leste (East Timor)

- Turkey

- Turkmenistan

- United Arab Emirates (UAE)

- Uzbekistan

- Vietnam

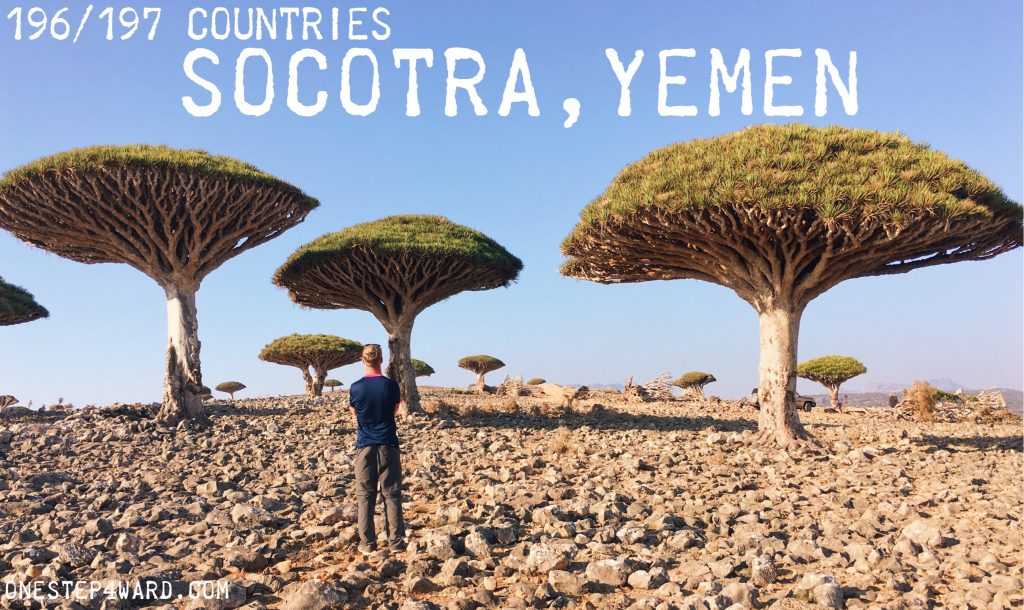

- Yemen (I now run tours to Socotra, Yemen – next one is in January 2021, let me know if you’d like to join!)

The UN considers the 49 countries above within Asia, but wait!

I’ve removed 5 countries, leaving us with 44 countries in Asia. These are the countries removed:

- Cyprus

If you locate Cyprus on the map you’ll soon notice that it is a lot closer to Europe than Asia, so it comes as no surprise that people often list it as being part of Asia but historically it’s seen as part of Europe. Its location is so open to interpretation that some people even place it in the Middle East.

- Georgia, Azerbaijan and Armenia

The Eurasian Caucasus region includes Georgia, Armenia and Azerbaijan. So everything within that mountain range is therefore considered Europe in terms of the European tectonic plate. Armenia, Azerbaijan and Georgia, therefore, are all considered part of Europe. Turkey is separate from that logic as it stretches further still south into the Middle East which is definitively part of the Asian continent. For example too, Most Armenians consider themselves to be European and not Asian. The same then goes for disputed territories in the Caucusus too – Abkhazia, South Ossetia and Nagorno-Karabakh.

- Egypt

Egypt stretches from the northeastern part of Africa all the way into the Middle East. It may be transcontinental but over 90% of Egypt is within Africa. The majority of the country lies in Africa and just a tiny portion in Asia with the Sinai Peninsula. So it shouldn’t be considered part of Asia, but instead Africa.

Taiwan, Palestine and Hong Kong explained

The UN stated 49. We took away 5, leaving us with 44. Now we’ll add 3 more countries to that 44, bringing us back to 47. The 3 additional Asian countries are as follows:

45 – Taiwan

100% a county. The reason is doesn’t make the UN list is because China claims ownership of the territory. China, as we all know, wields a huge amount of power globally so unfortunately there aren’t any big players forcing the issue for Taiwan to be officially recognised as an independent state.

46 – Palestine

100% a country. I’d say it’s one of my favourite place in the world. It is a non-member observer state by the UN and 138 UN members recognise it as a country – an interesting fact I learnt when there was that Russia was one of the first to recognise it as an independent state.

47 – Hong Kong

The one that is up for debate the most. Hong Kong is an autonomous region which is officially part of China (prior to 1997 it was part of the UK). It’s a special case because it’s part of the ‘one country, two systems’ idea – they control most things apart from defence and foreign affairs. They have their own passport, their own flag and it seems like the large majority doesn’t identify as being part of China – so, for me, it’s a country. The Chinese will disagree.

Other Territories With Internal Sovereignty in Asia

So that’s my count list of 47 countries that I see as part of Asia. There are 3 more places in the continent I don’t add to the list of countries. These are places that belong to other sovereign states, but in many people’s eyes, they are countries. I’ll let you decide what you think about that.

- Macau

Macau is an interesting place which is well worth a visit if you’re in Hong Kong, you can have a flutter in the casinos and check out the colonial architecture from when it was a Portuguese colony. It doesn’t as a country though, it is a special administrative region which is owned by China.

- Nothern Iraq

Northern Iraq is an autonomous region in the northern part of Iraq., it has its own regional government but isn’t a country. In the capital city, Erbil, they have 32 diplomatic missions, plus the UN and EU. I think it’s close to a country as you can get, with it’s own flag and national sports teams. I can’t add it to my list just yet though – but you have to visit if you want to tick off every place in Asia.

- Tibet

Ethnically and culturally independent of China, with a different language, flag and national identity. But China ‘owns’ Tibet for want of a better word. Although you need special permits/visas to enter Tibet, Tibetans do carry Chinese passports, and adhere to Chinese law.

FAQs about how many countries are there in Asia:

What are the largest and smallest countries in Asia by land area?

The largest country in Asia by land area is Russia, particularly its Asian part, which is also the largest in the world. The smallest country in Asia is the Maldives.

Does Asia include any transcontinental countries?

Yes, 2. Russia and Turkey. These are countries that have territory in both Asia and another continent. For Russia, the larger portion of its territory is in Asia, while a smaller part lies in Europe. Turkey’s smaller portion in Europe is separated from its larger Asian part by the Bosporus Strait.

How is Asia divided into regions and how many countries are in each region?

Asia is commonly divided into six regions: East Asia, Southeast Asia, South Asia, Central Asia, Western Asia, and Northern Asia.

The number of countries in each region varies, with South Asia having 8 countries, Southeast Asia 11, East Asia 6, Central Asia 5, Western Asia approximately 18, and Northern Asia is often represented solely by Russia due to its vast area.

Final Thoughts On How Many Countries in Asia

How many countries are there in Asia? 47 (my count), 49 (UN count), 50 (the fair count).

So, are we looking for an official count of how many countries there are in Asia? The answer is 47 (46 if you don’t consider Hong Kong independent enough of China to be seen as a country).

If we’re looking at how many places you need to have on your list to say you’ve travelled to Asia fully then I think that’s 52. The standard 52 from above + Northern Iraq, Tibet, and Macau. What do you guys think? Let me know if you agree with my count.

Remember, never travel without travel insurance! And never overpay for travel insurance!

I use HeyMondo. You get INSTANT quotes. Super cheap, they actually pay out, AND they cover almost everywhere, where most insurance companies don't (even places like Central African Republic etc!). You can sign-up here. PS You even get 5% off if you use MY LINK! You can even sign up if you're already overseas and traveling, pretty cool.

Also, if you want to start a blog...I CAN HELP YOU!

Also, if you want to start a blog, and start to change your life, I'd love to help you! Email me on johnny@onestep4ward.com. In the meantime, check out my super easy blog post on how to start a travel blog in under 30 minutes, here! And if you just want to get cracking, use BlueHost at a discount, through me.

Also, (if you're like me, and awful with tech-stuff) email me and my team can get a blog up and running for you, designed and everything, for $699 - email johnny@onestep4ward.com to get started.

Do you work remotely? Are you a digital nomad/blogger etc? You need to be insured too.

I use SafetyWing for my digital nomad insurance. It covers me while I live overseas. It's just $10 a week, and it's amazing! No upfront fees, you just pay week by week, and you can sign up just for a week if you want, then switch it off and on whenever. You can read my review here, and you can sign-up here!

As you know, blogging changed my life. I left Ireland broke, with no plan, with just a one-way ticket to Thailand

and no money. Since then, I started a blog, then a digital media company, I've made

more than $1,500,000 USD, bought 4 properties and visited (almost) every country in the world. And I did it all from my laptop as I

travel the world and live my dream. I talk about how I did it, and how you can do it too, in my COMPLETELY FREE

Ebook, all 20,000

words or so. Just finish the process by putting in your email below and I'll mail it right out to you immediately. No spam ever too, I promise!

As you know, blogging changed my life. I left Ireland broke, with no plan, with just a one-way ticket to Thailand

and no money. Since then, I started a blog, then a digital media company, I've made

more than $1,500,000 USD, bought 4 properties and visited (almost) every country in the world. And I did it all from my laptop as I

travel the world and live my dream. I talk about how I did it, and how you can do it too, in my COMPLETELY FREE

Ebook, all 20,000

words or so. Just finish the process by putting in your email below and I'll mail it right out to you immediately. No spam ever too, I promise!