How to Start a Travel Blog in 2025 (UPDATE: January 2025)

How to Start a Travel Blog; A 5 Step Guide to How You Can Start a Travel Blog in Less Than 30 minutes…

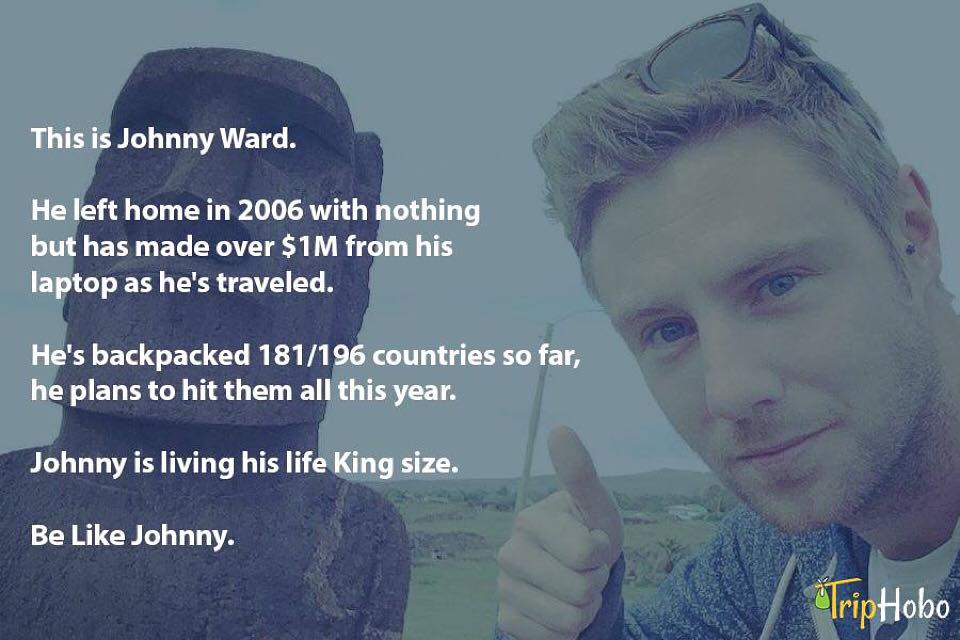

UPDATE MARCH 31ST, 2025. Blogging changed my life, I went from being a broke English teacher in Asia to making over a million dollars from my travel blog, buying properties in London and Bangkok, Thailand, travelling to EVERY country in the world, and now truly being free. That’s my honest story. I get invited to luxury hotels in every corner of the world, get offers to keynote conferences from Algeria, to Dublin to Hungary. TV shows, free gear, respect in my field. All from my blog. Starting my travel blog changed my life, now I want to show you guys how to start a travel blog too.

In this article, I’ll teach you how to start a travel blog in about 30 minutes tops, and for less than $70 total. Get ready to change your life….

TLDR? You can start a blog for $1.99 A MONTH HERE! DM me on instagram.com/onestep4ward if you need any extra help.

Table of contents

- How to Start a Travel Blog in 2025 (UPDATE: January 2025)

- STEP 1. Choosing The Name of Your Blog

- STEP 2. Getting Your Blog Online.

- PART A) Click the big ‘GET STARTED NOW’ button in the middle of the screen…

- PART B) PICK YOUR PLAN:

- PART C) Buying your blog name (Domain Name)

- PART D) Fill in your details

- PART E) Creating your BlueHost password

- STEP 3. Making Your Blog Look Like a Blog – Installing WordPress

- PART A) Bluehost has implemented a new feature that automatically installs WordPress as soon as you register for hosting.

- PART B )

- PART C )

- Your blog is now on the internet. Your site is LIVE. See that was much cheaper than you thought, much easier than you thought and much faster than you thought, right? Awesome. Next stop… Hawaii. Ok ok, not yet, but you’re on your way!

- STEP 4. Logging into your Site and Designing Your Blog

- STEP 5. SOCIAL MEDIA, MAKING MONEY AND EVERYTHING ELSE

- A) Can anyone really start a blog?

- B) Do I need to speak English to start a travel blog?

- C) There are so many blogs, maybe I’m too late to start a travel blog?

- D) I haven’t travelled that much, can I start a travel blog?

- E) How to Start a Travel Blog? How much does it cost to start a travel blog?

- F) How to Start a Travel Blog? But you can set up a free blog, right? Why would I pay?

- G) Can I really make money blogging?

- H) OK, So how much money can I make from a travel blog?

- TECH CHAT GLOSSARY

Going Viral

After my story went viral, from Forbes to Yahoo, to BBC and FHM, I’ve been getting emails and messages on my Facebook page and Instagram every single day asking how you too can start a blog, make money and travel the world.

So let me lay it out, step by step here, along with some very frequently asked questions and a tech glossary explaining all these weird tech words at the bottom.

I should add I’m AWFUL with technology, so if I can start a blog and make it popular, and make great money from it every month, as well as endless ‘free’ trips as a perk, then you really, really can too.

I personally think everyone should have a blog, whether its a travel blog, fitness blog, lifestyle, fashion, beauty or anything. Worst case scenario is that it’s a great diary of your life that you will have forever, and it gives you a voice, not to mention a great additional feature to a resume. Best case scenario is endless free trips, and six figures a year just talking about your life. Yes, please. I’m going to teach you how to start your first blog.

With that in mind, let’s move on to how to start a travel blog, step by step. If you follow this, you’ll have a blog in about 30 minutes:

STEP 1. Choosing The Name of Your Blog

First you need to rent the space on the internet to start your travel blog, you can do that HERE for $1.99.

When working out How to Start a Travel Blog, this is super important, put some real thought into it. Your blog can define your online persona, and it’s here to stay. Here are some quick tips to keep you on the straight and narrow:

A) Don’t Pigeon Hole Yourself

The best advice I can give is to not pigeon-hole yourself with your blog name. “24yearoldtraveler.com” may sound good now, but next year it’s already out of date! Equally, you might think superbudgettraveler.com is a winner today, but 5/10 years later when your travel style is a little more luxurious, your blog no longer fits you. Be careful.

Choose something you can mould into something else should you wanna do that later down the road. Try to keep it general so your blog can mature/evolve just as you do. For me, One Step 4 Ward allows me to do that, I didn’t have a clue about online business when I started, but now my blog name allows me to incorporate that which is great. Be smart about your choice, you don’t want to have to change it later and start again.

B) Be Smart with Your Characters

Be careful with numbers, abbreviations etc. I WISH someone told me this when I choose OneStep4Ward.com. Most of my blog conversations now start like this….

“What’s your blog?“

“One Step Forward, but no, with the number four, yeah the digit, not the word ‘forward’… ermmm.. hang on I’ll write it down, eurrrgh“

I have this conversation daily, don’t make my mistake. Keep it simple as possible, and avoid numbers, abbreviations, hyphens if possible.

C) Be Professional

When it comes to working with big brands, luxury hotels and creating products – these businesses don’t want to be aligned with dubious bloggers so anything referencing drugs, getting drunk, having sex might seem cool now, but when Nikon, or the Four Seasons refuse to work with you 2 years later because of your branding, you will wish you choose something more professional. Think ahead.

STEP 2. Getting Your Blog Online.

First I’ll explain how it works, then I’ll take you through step by step….

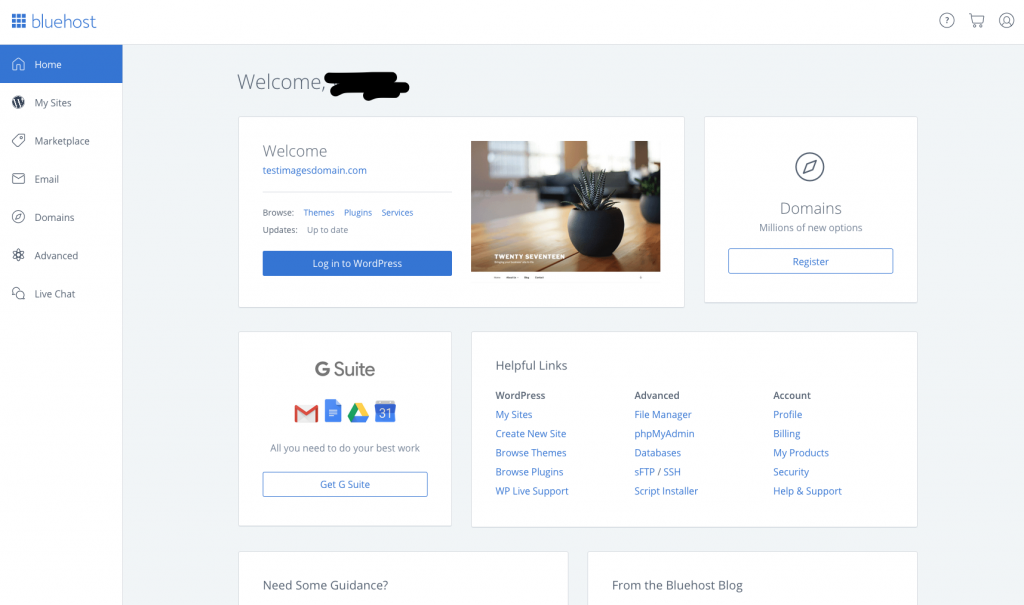

How to Start a Travel Blog starts here! To get your blog online you need to set up hosting (see the next paragraph) and you need to buy your blog name (this is referred to as your Domain Name). It’s much better and easier to use the same company to both buy your domain name, and set up the hosting. Then when you have any issues, you only have one point of contact.

Hosting your website.

Sounds confusing I know, but it’s not I promise. Hosting your website essentially means ‘renting’ the space on the internet that your blog will appear on. In the same way, you may rent your apartment to live in, you have to rent the space for your blog to live in. Easy peasy. There are lots of companies – GoDaddy, HostGator etc and having used tried, fought with and left them all, I would only ever recommend, BlueHost. Their rates are super cheap at between $3.95 and $5.95 per month. They also offer a 30-day money-back guarantee, they have live chat to talk you through your tech problems (something I often need!) AND they let you have your domain name for free when you first register! Winner!

Buying Your Website:

If your website is available (no one else has registered it before), then you buy the rights to the name, for example, ‘YOURNEWTRAVELBLOG.com’. This roughly costs around $15 per year, BUT like i mentioned above if you go through my guys at BlueHost when you register your hosting with them too, they give your domain registration to you for free. Boom.

Ok, so now since thinking how to start a travel blog, we’re making progress already. You’ve chosen your blog name (from Step 1) , you understand what hosting and buying your domain is is (from Step 2) head over to the Blue Host home page and let’s get your travel blog started today. This is what you see….

PART A) Click the big ‘GET STARTED NOW’ button in the middle of the screen…

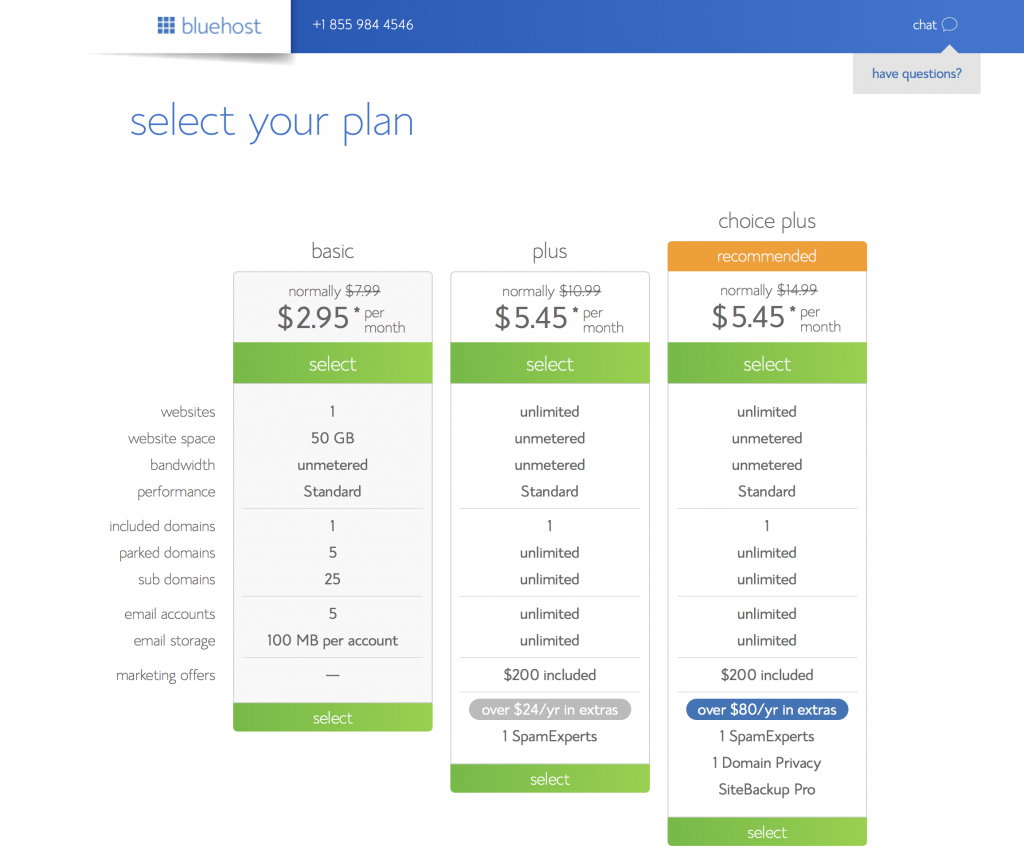

PART B) PICK YOUR PLAN:

Now you have to choose which hosting plan you want, the cheapest option is fine, I own hundreds of sites and have only ever chosen ‘starter’.

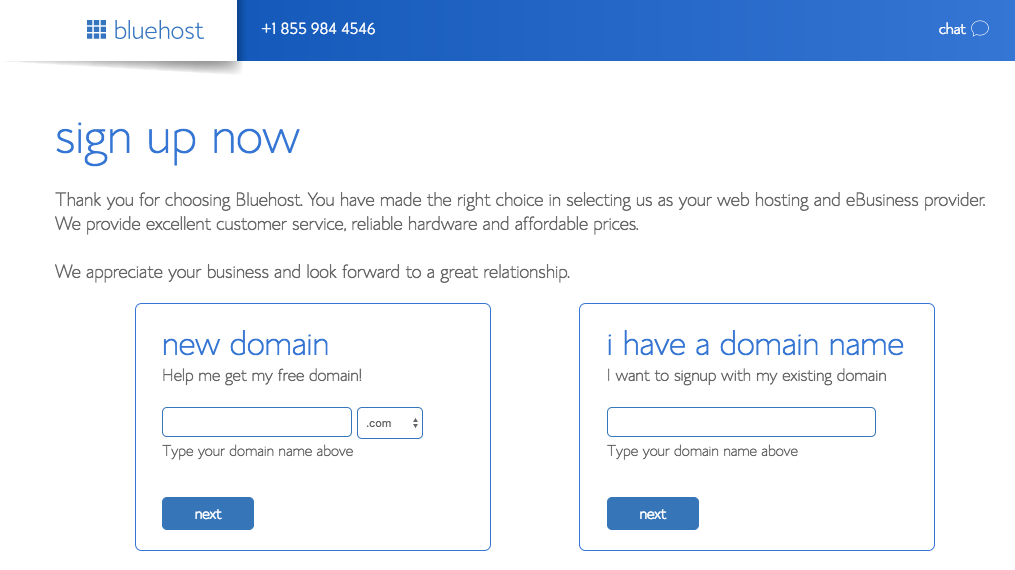

PART C) Buying your blog name (Domain Name)

After you have chosen your plan from the PART B above, you will be presented with this page, this is where you can check the availability of your blog name, and then go on and purchase it. Type the name of the blog you want to buy in the box on the left, and click ‘next’. If someone else has already snapped it up, don’t panic. Think of some alternative blog names, try those, you’ll find the right one for you. When you find your perfect available domain, click ‘next’…

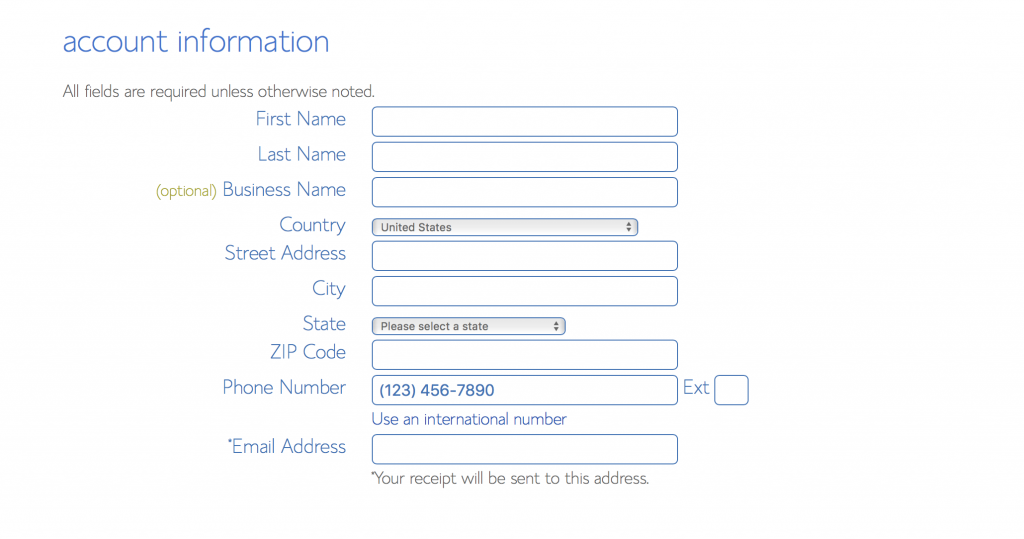

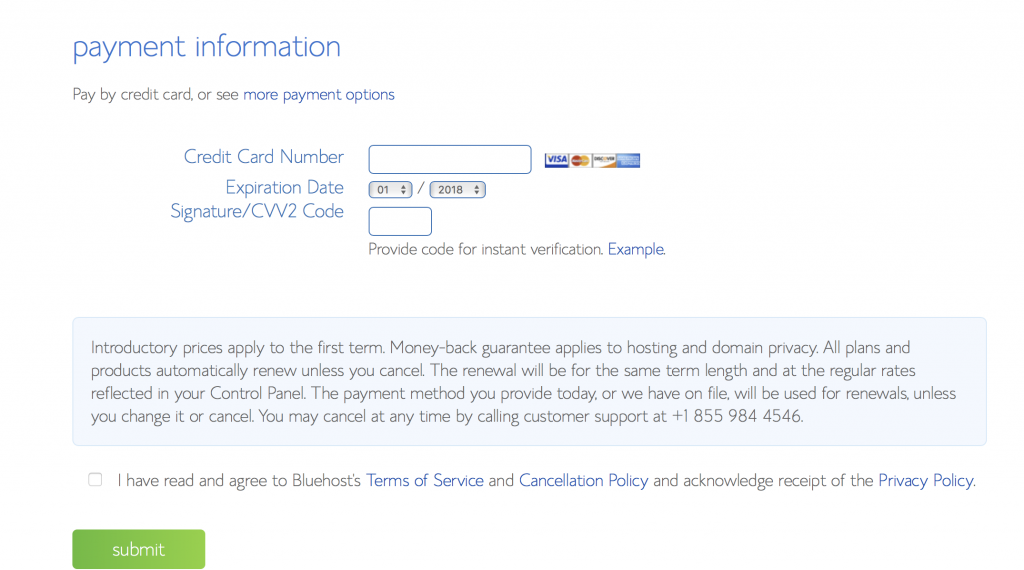

PART D) Fill in your details

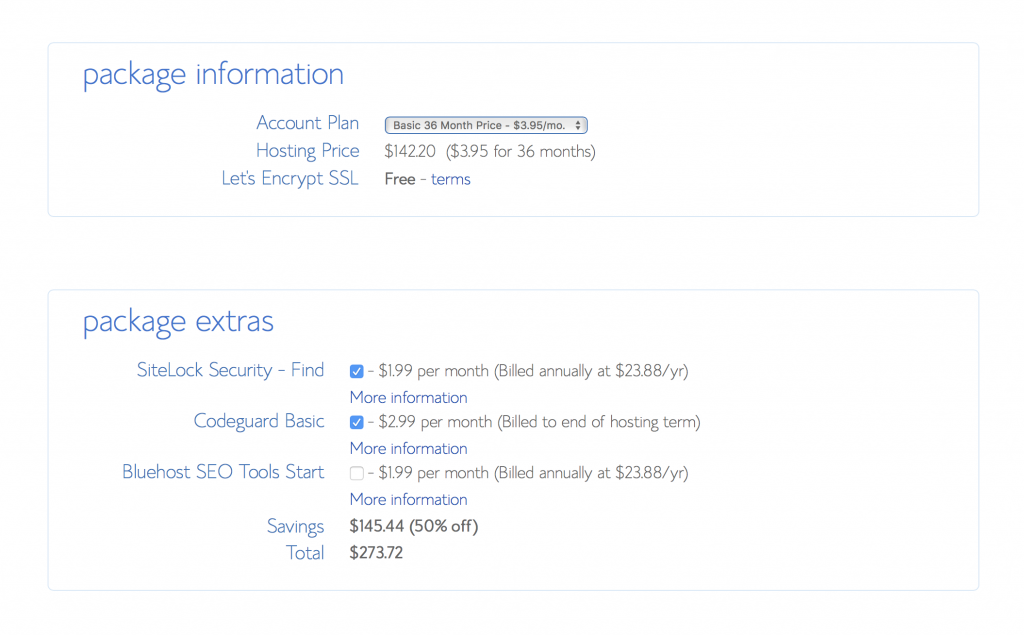

You can now choose to sign up your hosting for 1-3 years, with the prices varying from between $3.95 and $5.95 per month. If you’re a first time blogger, I’d say the 1 year option is best, but it’s up to you.

All the extra stuff you can add on? Remove it all. The only one you may choose to keep is domain privacy so no-one can find out who owns your blog. I don’t bother with it though.

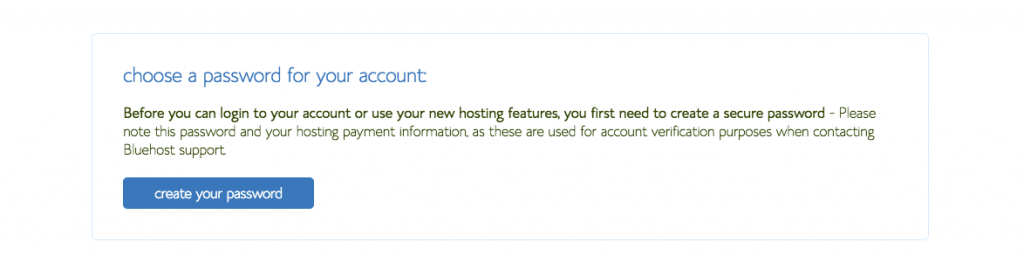

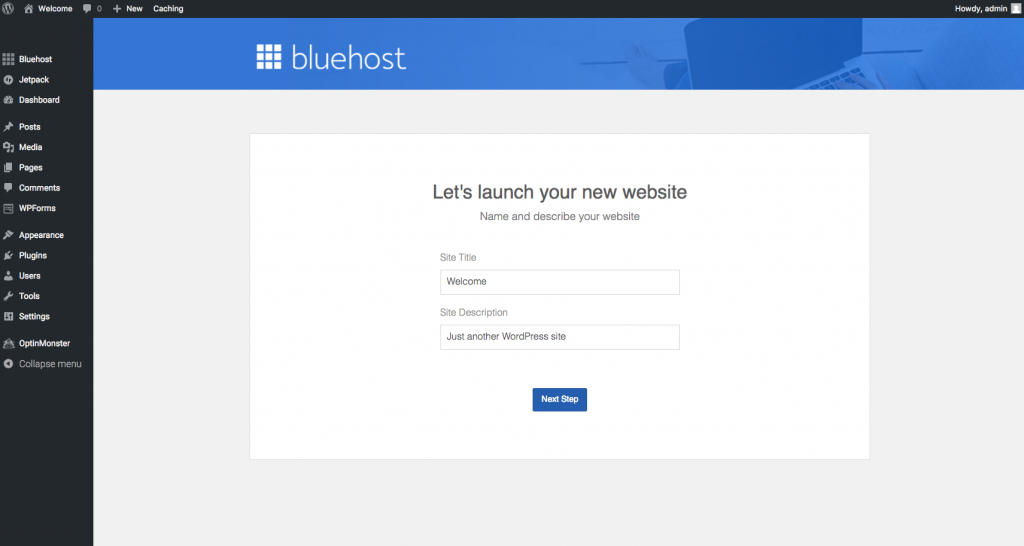

PART E) Creating your BlueHost password

After you complete the filling your details stage, you’ll be greeted by this screen, click on ‘create your password’

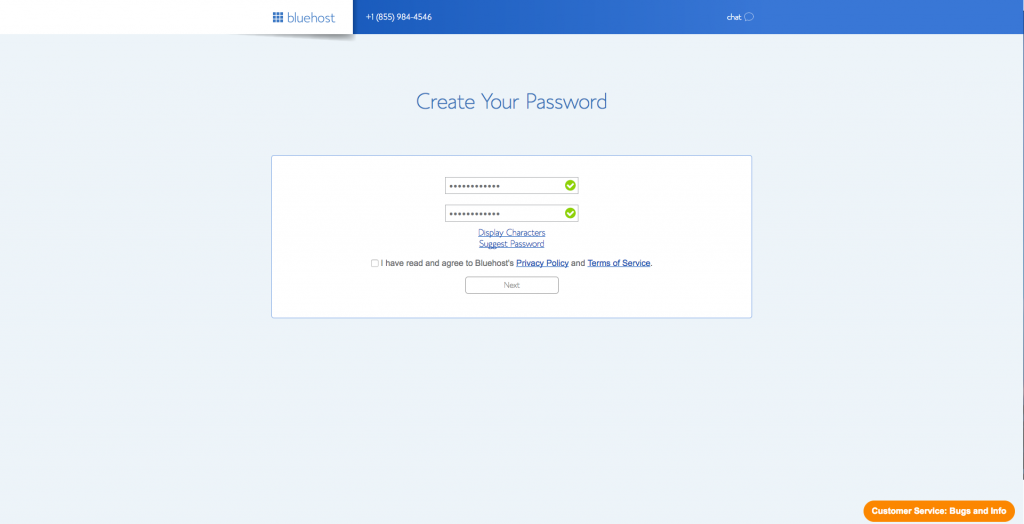

This screen appears, go ahead and create your password

STEP 3. Making Your Blog Look Like a Blog – Installing WordPress

Great, so you were working on How to Start a Travel Blog and now already you’ve sorted out your domain registration (you’ve bought your blog name), and your hosting (you’ve rented the online space for your blog), you’re ready for it to actually be live, on the internet and look like a blog. Awesome, well done so far!

Here you need to install WordPress from your BlueHost control panel. WordPress is FREE software that allows you to publish articles, add advertising, change your design etc and it’s all super user friendly. There are other platforms – Blogspot, blogger etc, don’t use them! WordPress is the one every successful blogger users, me included.

Ok, so how do you add WordPress, let me give you some screenshots to avoid confusion:

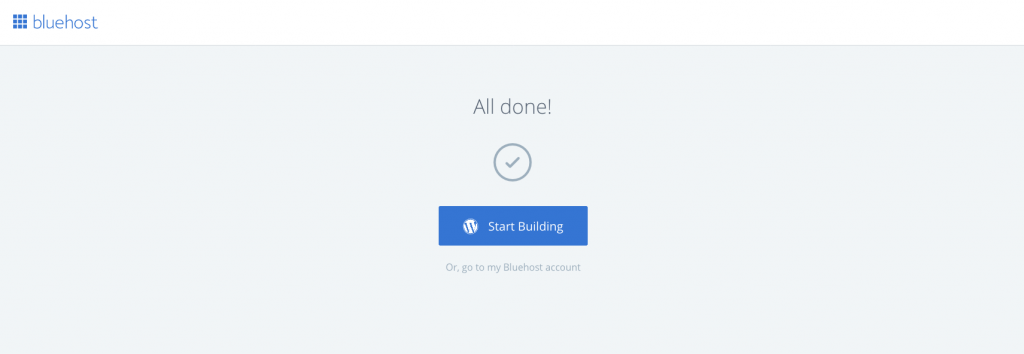

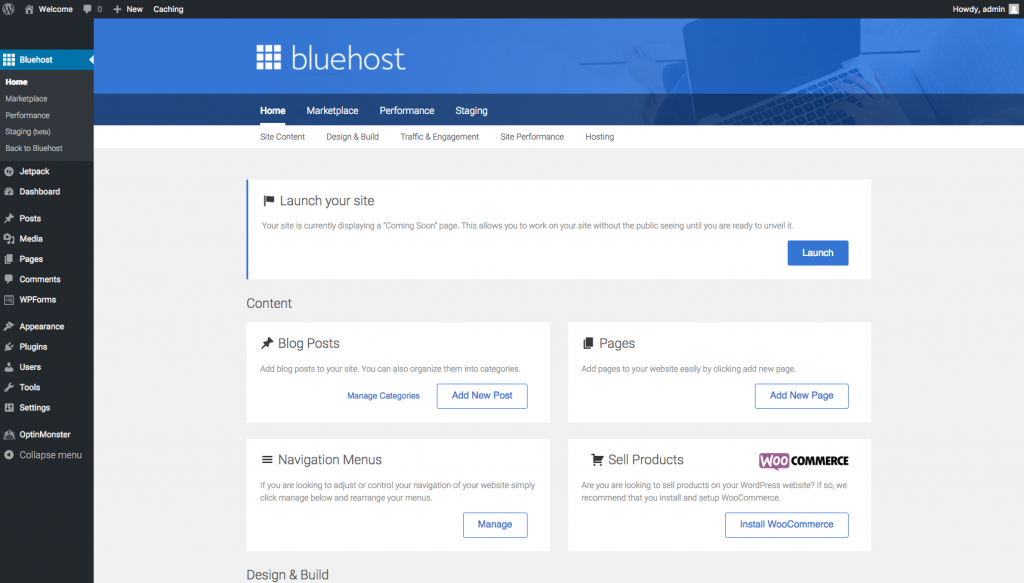

PART A) Bluehost has implemented a new feature that automatically installs WordPress as soon as you register for hosting.

PART B )

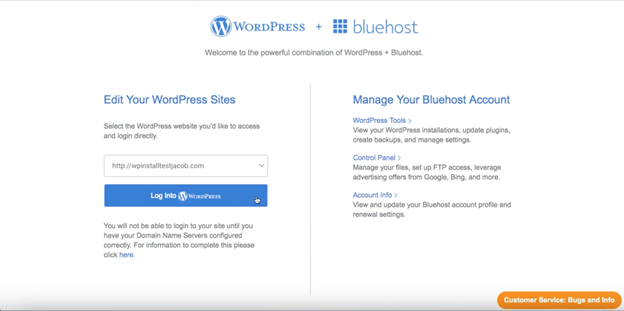

After WordPress is installed, input your domain name in the Edit Your WordPress Sites section.

PART C )

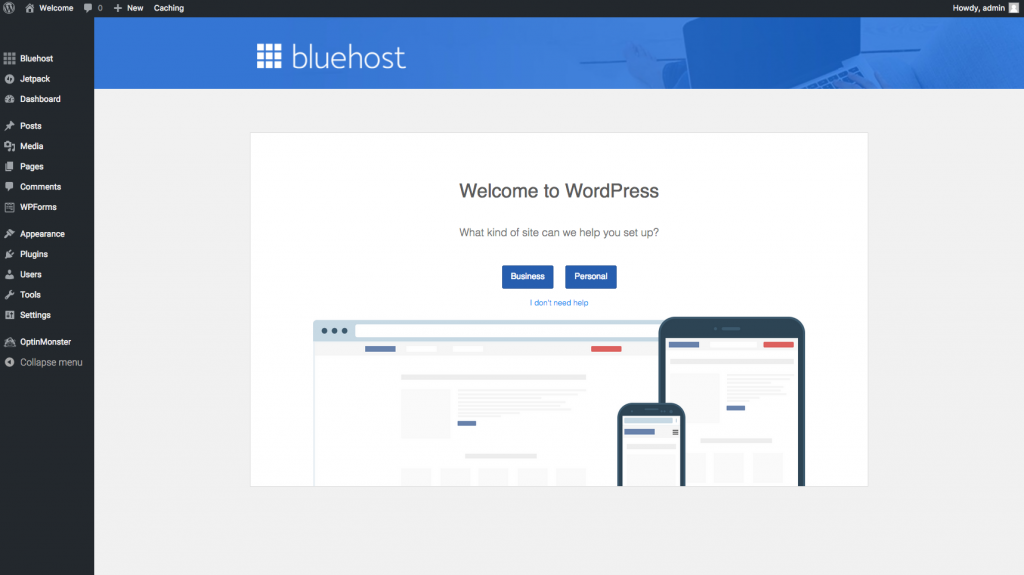

Once you input your domain and password, you will be sent directly to your new blog’s dashboard on WordPress.

Your blog is now on the internet. Your site is LIVE. See that was much cheaper than you thought, much easier than you thought and much faster than you thought, right? Awesome. Next stop… Hawaii. Ok ok, not yet, but you’re on your way!

STEP 4. Logging into your Site and Designing Your Blog

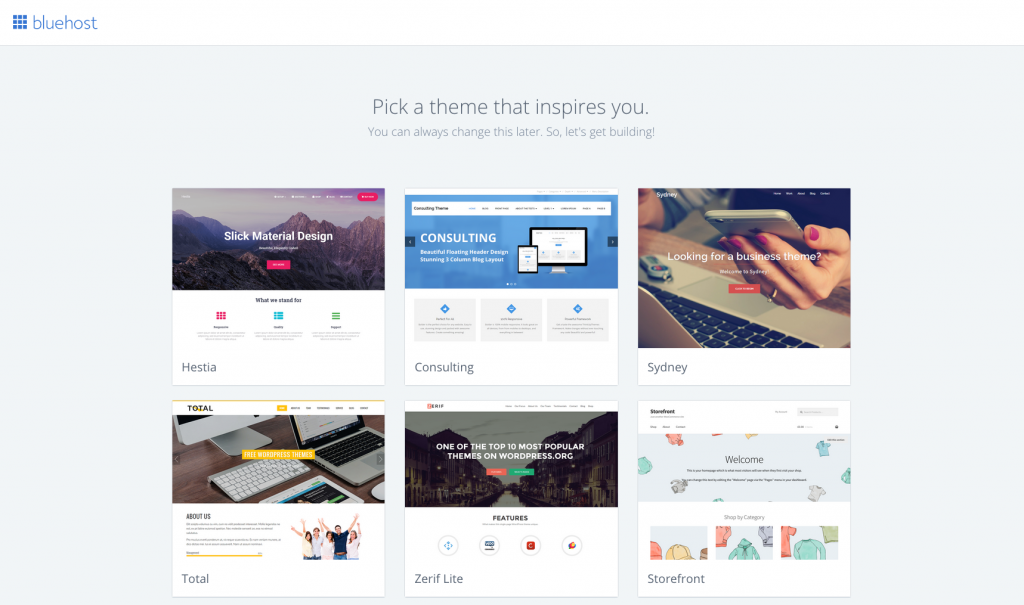

Now you need to install a design (referred to in WordPress as a ‘theme’) for your new blog. You’ve sorted out your hosting through BlueHost, now you have to renovate your site (by adding a theme on WordPress). If you to go to the URL (remember that the full version of your site, like https://www.onestep4ward.com for me, or http://www.YOURNEWTRAVELBLOG.com), you’ll see a super basic website. Now you need to make it a little sexier.

PART A)

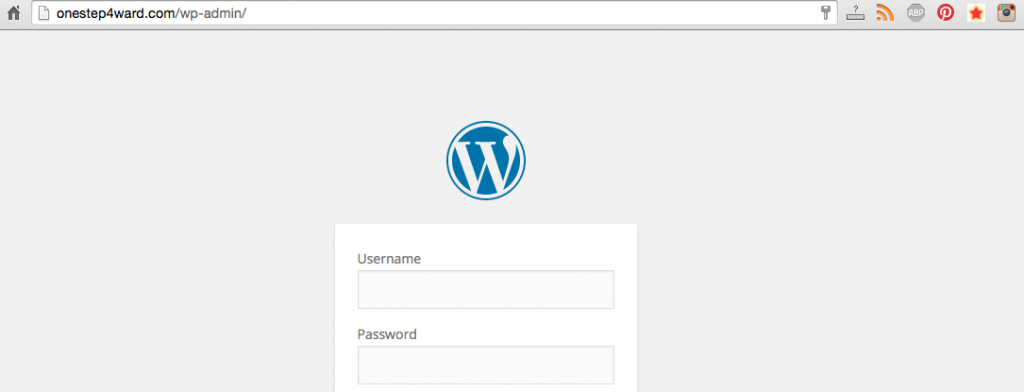

Now go to: http://www.YOURNEWTRAVELBLOG.com /wp-admin

Use your username and password from Part G in Step 2 and sign-in to the backend of your sexy new website…

The ‘Back End’ of your blog is like the control centre, where you can edit everything, publish blog posts etc. Only you can access this, not your readers. We call this the ‘Dashboard’

PART B)

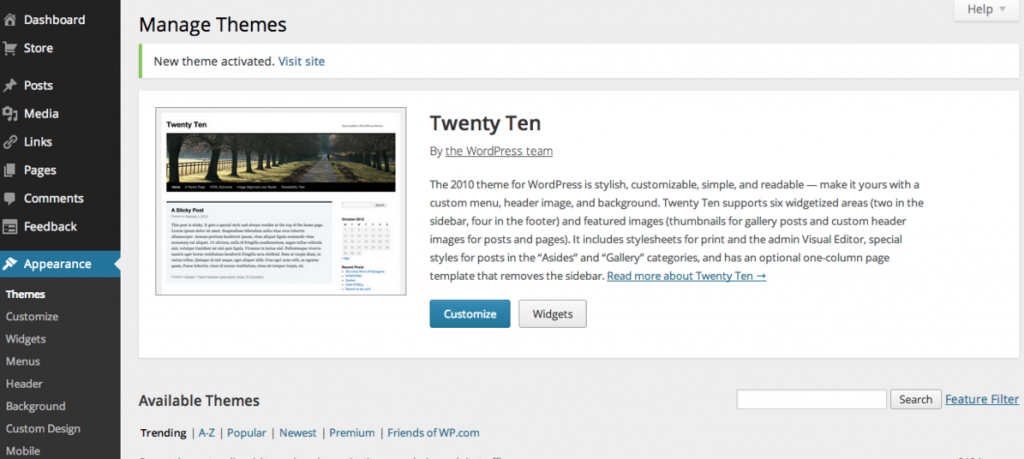

Once logged into the backend of WordPress, you go to the sidebar in the left hand side, find ‘Appearance’, hover over it, and click ‘Themes’ when it pops up.

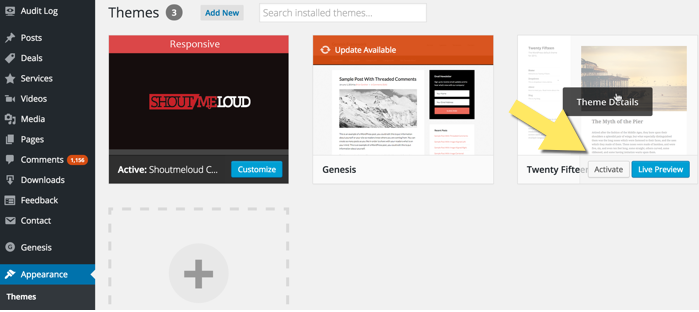

There are hundreds of free themes you can choose, so choose one you like the look of, hover over it, and click activate. Don’t worry, none of this is permanent, so you can try a few out, once you’ve chosen one and clicked activate, go to the address bar, type in your new website URL http://www.YOURNEWTRAVELBLOG.com and you can see your new theme. Done.

Choose a free theme, and click ‘activate’

PART C)

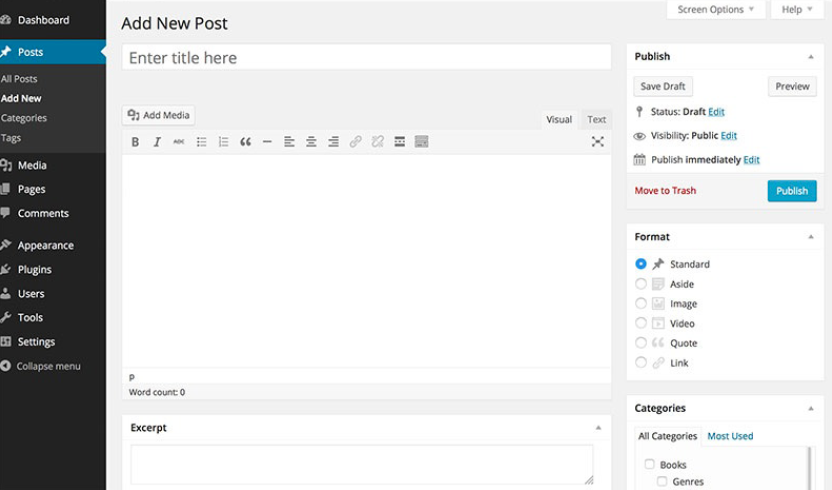

All’s left now is to publish your first blog post, so go back to that black sidebar on the backend of your WordPress, hover over ‘all posts’, click on ‘add new’. Then title your blog post ‘My first post yaaaay!”, and in the subject box write something like “This is where my new life begins….”, click publish on the right-hand side.

Now go back to the live version of your new blog onYOURNEWTRAVELBLOG.com!! And it’s live, CONGRATULATIONS!

NOTE: The free themes aren’t super-duper sexy, but if you don’t want to spend any more money, then, of course, they’ll do. You can find some premium themes from major WordPress designs companies like Woo Themes, or you can hire someone to design it for you.

For me, I’m awful at design stuff, am terrible at technology and generally it was beyond me, so I hired a freelancer to design my site for me. Now thankfully, since my blogging took off, I have a team of guys at my media company Step4WardMedia.com who do all my tech stuff for me. The good news is that they can design your blog for you too, we do cute, clean, basic designs starting at $300, so drop me a message on johnny@onestep4ward.com if you want my guys to do it for you.

PART D) Plugins

Plugins are useful little widgets that make your blog a lot better. Like an area for people to comment on your blog posts or a way for people to share your content via social media. You can see the ‘plugins’ in the left sidebar, but for now make sure you install all these free plugins:

- Akismet – to stop spam

- WordPress SEO – this will help you rank better in Google, you’ll learn more about this in time

- WPTouch – to make your site perform better on phones and tablets

- Easy Social – so people can share your content via their social media

- Contact form – so people can get in contact with you

- Plugins are useful little widgets that make your blog a lot better. Like an area for people to comment on your blog posts or a way for people to share your content via social media. You can see the ‘plugins’ in the left sidebar, but for now make sure you install all these free

STEP 5. SOCIAL MEDIA, MAKING MONEY AND EVERYTHING ELSE

From this point on, there’s still a lot more to learn. How to Start a Travel Blog doesn’t stop once you’ve just started publishing articles! Pages, plugins, your menu options, networking, media packs, SEO, online marketing, affiliate marketing, monetizing. But you’ve done the hardest part, now blog and don’t give up.

PART A) Social Media

Make sure you create profiles for your blog in the following:

- Facebook page (this is different from your profile)

- Instagram Account

These 3 are absolute musts, you can/should also create profiles for:

PART B) About you

‘About Me’ rather. Create your ‘About Me’ page so people can hear your story. You can check mine out here too. If you can face talking to the camera, a video here is even better. Don’t sell yourself short, talk about your experience, about your hopes and dreams. Be open, be honest and most importantly be yourself.

PART C) Making Money

I know, I know you all want to know about how to make a million dollars, but be patient. Just because now you know HOW to start a travel blog doesn’t mean you’re earning a fortune on day 1! Spend the first 6 months to a year creating quality content, learning the blogging ropes, building an audience (priority). DON’T WORRY ABOUT MAKING MONEY, DON’T EVEN THINK ABOUT IT FOR SIX MONTHS OR MORE. Once you have an audience, then you can consider how to make money, but believe me when I say building the audience is the toughest part, once you have your audience, you can make money guaranteed. Here are the methods successful bloggers have monetized their sites:

- Affiliate Marketing

- Google Adsense

- Sponsored Posts

- Brand Ambassadorships

- Public Speaking

- Freelance Writing

- Ebooks

- Products/Courses

- Tours

There are a million and one ways to make a million and one dollars. DON’T FOCUS ON THE MONEY. Focus on making your blog popular, never forget this. Create value from your blog, and it’ll come back to you. I promise. Good luck and feel free to message me if you need any help.

PART D) Google Analytics

You want to track your traffic, and your journey. Google analytics lets you track every bit of data imaginable, but most importantly it lets you see how many hits and visits you’re receiving. You can see what kind of posts are resonating well, and which ones aren’t so much. It’s invaluable, and when it comes time to work with awesome hotels, and big clients, they’ll want all this info, so get it going from the outset. Sign up here, it’s free: https://www.google.com/analytics/

PART E) Be Yourself and ENJOY!

Perhaps the most important part of all of this blogging stuff is to be yourself, so after learning How to Start a Travel Blog it’s time to show your true self to the world. There’s never been a time in history with so much opportunity, so much potential freedom, so many chances to do things we could never have previously dreamt about. Blogging can be your key to that lifestyle. So find your voice and shout it loud. Let me know if I can help you guys in any way, blogging changed my life and I hope it can change yours too.

Johnny

FAQ

A) Can anyone really start a blog?

YES – START HERE.

Yes, pretty much anyone. I know almost nothing about tech, coding, design etc and I have managed to do it. As long as you can sign up to a host, and pay for your monthly fees, then you can do it. So essentially, if you have a credit/debit card, and can spare $60 a year or so, then you can do it.

B) Do I need to speak English to start a travel blog?

Definitely not. If you speak Spanish or Arabic then you can blog in your native tongue, there is a HUGE market out there for non-English speaking blogs. If you’re bilingual, then I’d blog in both languages, it increases your reach, and of course English has the biggest potential readership.

C) There are so many blogs, maybe I’m too late to start a travel blog?

There is ALWAYS room for a quality blog, ALWAYS. Don’t worry about the competition, if you take it seriously, then you can succeed. Simple as that. Travel blogging, and blogging in general, is one of the best ‘jobs’ in the world, it’s worth all the effort, I promise.

D) I haven’t travelled that much, can I start a travel blog?

Of course, you can, you can document your journey. Planning to travel, prep for travel, the emotions of wanting to hit the road. Actually, it’s a great idea to start a blog before you hit the road because by the time you hit the road, your site can be making you money.

E) How to Start a Travel Blog? How much does it cost to start a travel blog?

Very little. If you’re happy for a simple free WordPress design, then roughly $60USD per year or so. Super cheap.

F) How to Start a Travel Blog? But you can set up a free blog, right? Why would I pay?

Right BUT while it IS possible to get a free website from Blogspot, Tumblr and blahblahblah.wordpress.com. My advice? Don’t do this. You can’t make money from a free blog, you can’t build a big audience, people don’t read or trust free blogs, it’s restrictive with the design you can do. All-in-all, it’s unprofessional. I literally never open blogs that say .blogspot.com or .wordpress.com, or if it’s been done in wix.com. Avoid it. If you wanna make money online and have a voice that people listen to, then pay the $50 or so per year, it’s worth it, honestly.

G) Can I really make money blogging?

Yes, you can, really you can. But it won’t happen overnight. If you’re dedicated, then within six months or so you can get press trips, and travel without having to pay sometimes, within a year, if you take it seriously, you can live from your income, and beyond that, it’s up to you. How ambitious are you? How dedicated are you? I was hungry, so I made it happen. I don’t want a ‘real job’ ever, so I made sure blogging worked for me. If you have that attitude you can do well.

H) OK, So how much money can I make from a travel blog?

First, it was how to start a travel blog, and now already you wanna know how to get paid, right? Don’t worry, it’s normal! How long is a piece of string? Many bloggers make nothing, be aware of that. Famous travel bloggers can make hundreds of thousands of dollars per year. For me, making the first $100USD was key, from there the limit is determined by you. I expanded aggressively and bought more and more blogs, which in the end made me more than a million dollars. If I can do it, so can you. Honestly. But it all starts here.

TECH CHAT GLOSSARY

Don’t worry, I didn’t understand so many of the terms when I started either, let me try to break it down for you guys. If you need any more explanations, comment on my Facebook page or in the comments below and I’ll add those terms too, thanks.

URL: The actual name of your blog in the address bar, for example, the URL of OneStep4Ward is https://onestep4ward.com/

DOMAIN NAME: The name of your website, so for me it’s onestep4ward.com

HOST: In simplest terms, your host is the person who provides your internet space, kinda like a landlord you pay rent to. For example, BlueHost are my host for all my hundred+ websites. They manage your server.

SERVER: Where your website ‘lives’, like the garage where you keep your car. Your host manages this on your behalf for the monthly fee you pay them.

BROWSER: What you look at your websites on – internet explorer, safari, chrome.

NOTE: You should be using Chrome, both on your laptop and your phone, it’s so much better.

FTP: A username and password that will allow someone to access the files in your server and change it. Remember, the server is taken care of by your host.

SEO: Search Engine Optimisation. Basically making your site more appealing to Google and Google searches. If Google trusts you and your site, and thinks you’re creating helpful content for people searching, you will feature higher in the Google search results. Featuring higher = more visitors.

Affiliate Marketing: Links to products, hotels, courses within your blog. These links send your visitors to other sites like Amazon, or Booking.com and you make a small percentage of any of their purchases. If you have big traffic, you can make six figures a year with this. Honestly. And it’s passive income. The dream.

So you’ve been wondering how to start a travel blog, well now you know, so don’t hesitate. Start today, and if you’re serious about it, before long I’ll be seeing you on the road somewhere. Happy travels.

That’s it folks, feel free to message me on FaceBook.com/onestep4ward or Instagram.com/onestep4ward or Twitter.com/onestep4ward, or johnny ‘at’ onetep4ward.com. Feel free to bookmark my How to Start a Travel Blog article but there’s no time like the present to get started, it’s procrastination that keeps us from achieving our dreams. So make the move from the thought process of How to Start a Travel Blog to the reality of getting your blog live today! Good luck and let me know if you need help 🙂

Remember, never travel without travel insurance! And never overpay for travel insurance!

I use HeyMondo. You get INSTANT quotes. Super cheap, they actually pay out, AND they cover almost everywhere, where most insurance companies don't (even places like Central African Republic etc!). You can sign-up here. PS You even get 5% off if you use MY LINK! You can even sign up if you're already overseas and traveling, pretty cool.

Also, if you want to start a blog...I CAN HELP YOU!

Also, if you want to start a blog, and start to change your life, I'd love to help you! Email me on johnny@onestep4ward.com. In the meantime, check out my super easy blog post on how to start a travel blog in under 30 minutes, here! And if you just want to get cracking, use BlueHost at a discount, through me.

Also, (if you're like me, and awful with tech-stuff) email me and my team can get a blog up and running for you, designed and everything, for $699 - email johnny@onestep4ward.com to get started.

Do you work remotely? Are you a digital nomad/blogger etc? You need to be insured too.

I use SafetyWing for my digital nomad insurance. It covers me while I live overseas. It's just $10 a week, and it's amazing! No upfront fees, you just pay week by week, and you can sign up just for a week if you want, then switch it off and on whenever. You can read my review here, and you can sign-up here!

As you know, blogging changed my life. I left Ireland broke, with no plan, with just a one-way ticket to Thailand

and no money. Since then, I started a blog, then a digital media company, I've made

more than $1,500,000 USD, bought 4 properties and visited (almost) every country in the world. And I did it all from my laptop as I

travel the world and live my dream. I talk about how I did it, and how you can do it too, in my COMPLETELY FREE

Ebook, all 20,000

words or so. Just finish the process by putting in your email below and I'll mail it right out to you immediately. No spam ever too, I promise!

As you know, blogging changed my life. I left Ireland broke, with no plan, with just a one-way ticket to Thailand

and no money. Since then, I started a blog, then a digital media company, I've made

more than $1,500,000 USD, bought 4 properties and visited (almost) every country in the world. And I did it all from my laptop as I

travel the world and live my dream. I talk about how I did it, and how you can do it too, in my COMPLETELY FREE

Ebook, all 20,000

words or so. Just finish the process by putting in your email below and I'll mail it right out to you immediately. No spam ever too, I promise!